The presumed resulting trust and the automatic resulting trust are two different types of resulting trusts that arise in different circumstances and have different requirements.

A presumed resulting trust arises when there is a presumption or inference that the legal owner of property holds it for the benefit of another person. This presumption can arise when a person pays for property but puts the title in someone else's name, or when a person transfers property to someone else without receiving adequate consideration or intending to make a gift.

An automatic resulting trust arises when there is a failure of a trust, or when a trust comes to an end, and the property subject to the trust is returned to the settlor. This type of resulting trust arises automatically, without the need for any evidence of intention or agreement to create a trust. The property is returned to the person who originally owned it, unless there is evidence of an intention to create a different type of trust or transfer the property to someone else.

In summary, the main differences between the presumed resulting trust and the automatic resulting trust are:

- Presumption vs. automaticity: The presumed resulting trust arises from a presumption, while the automatic resulting trust arises automatically.

- Evidence required: The presumed resulting trust requires evidence to support the presumption, while the automatic resulting trust does not require evidence of intention or agreement to create a trust.

- Circumstances of creation: The presumed resulting trust arises in specific circumstances, such as when property is transferred without adequate consideration, while the automatic resulting trust arises when a trust fails or comes to an end.

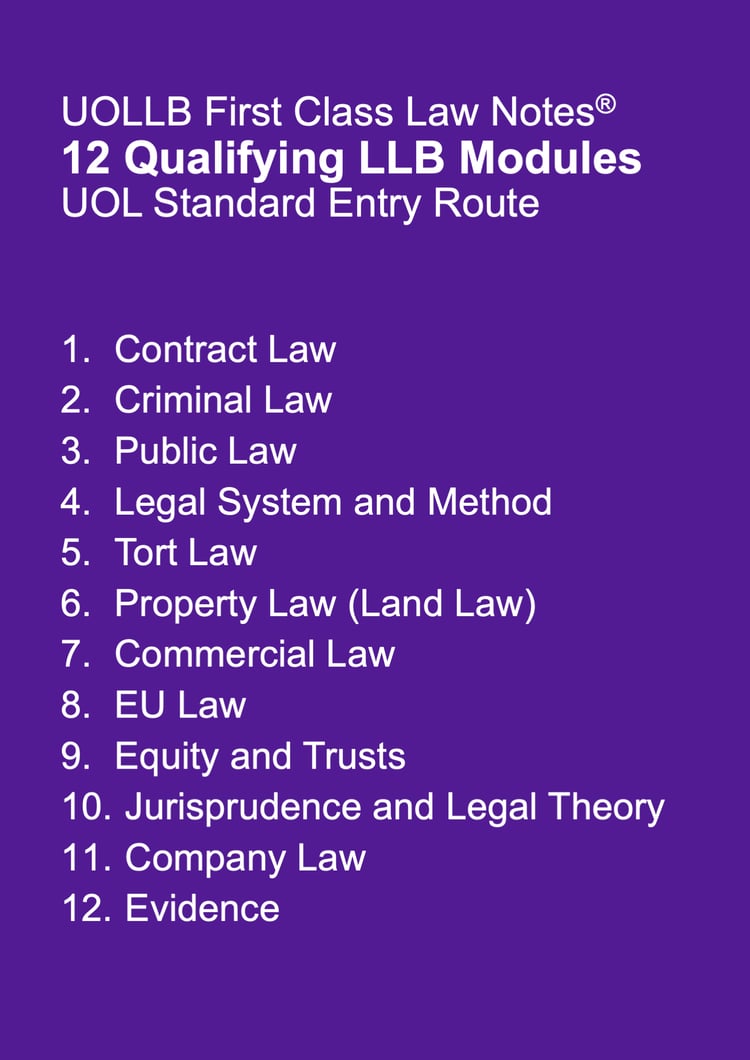

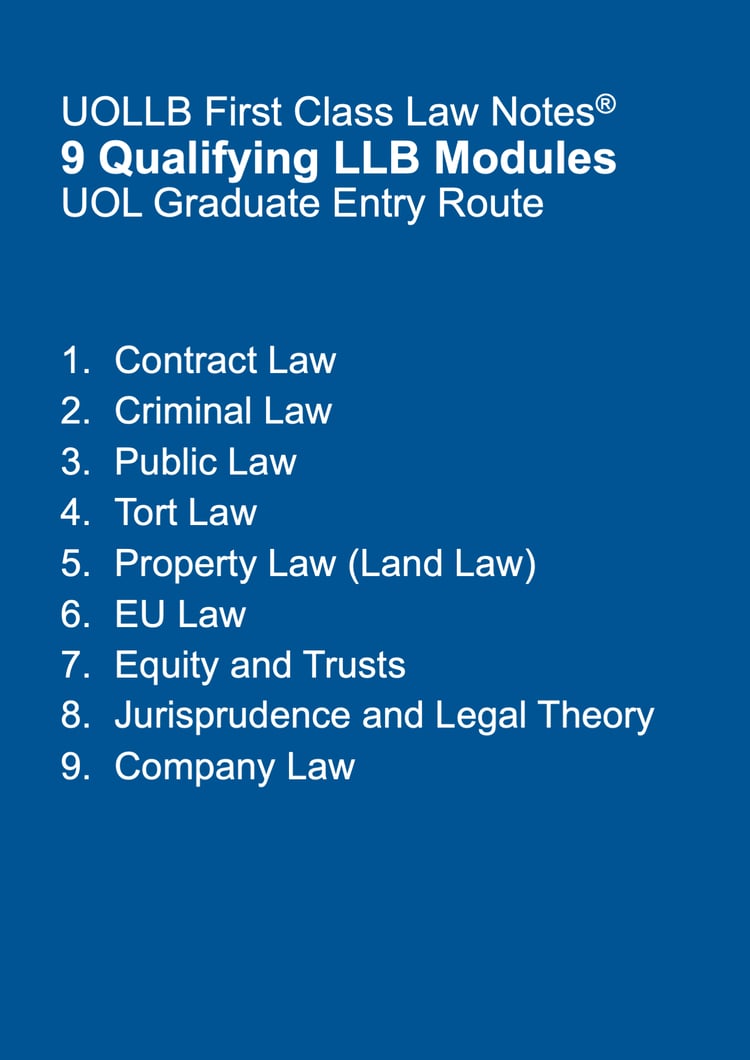

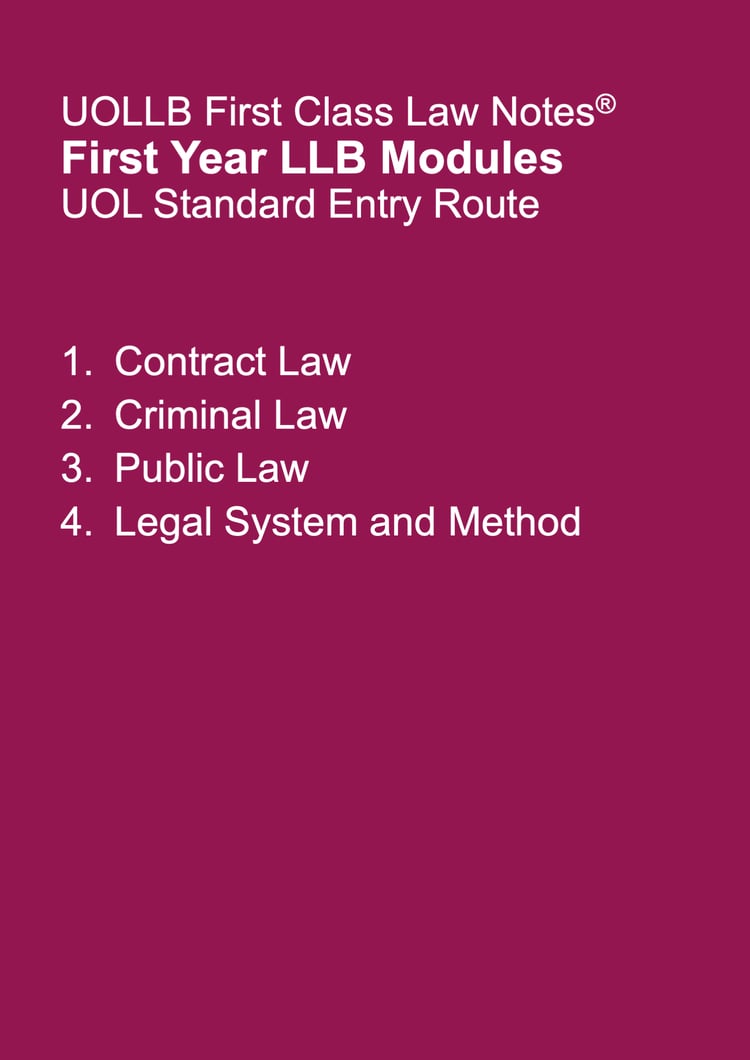

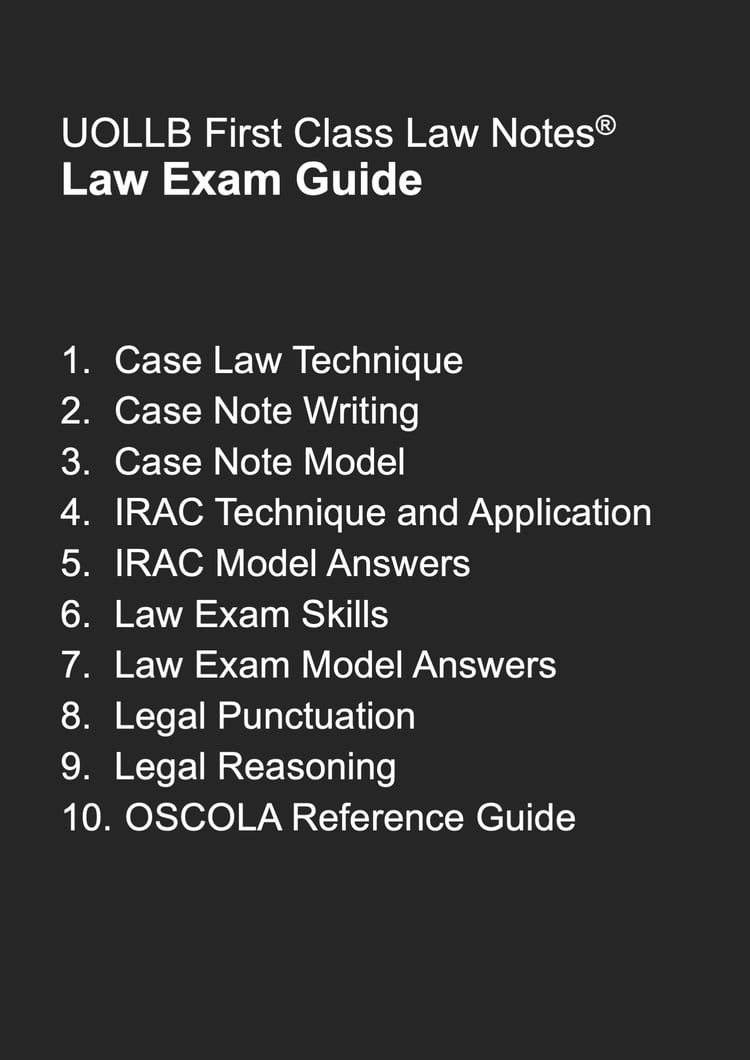

You can learn more about this topic and relevant case law with our Equity and Trusts notes.