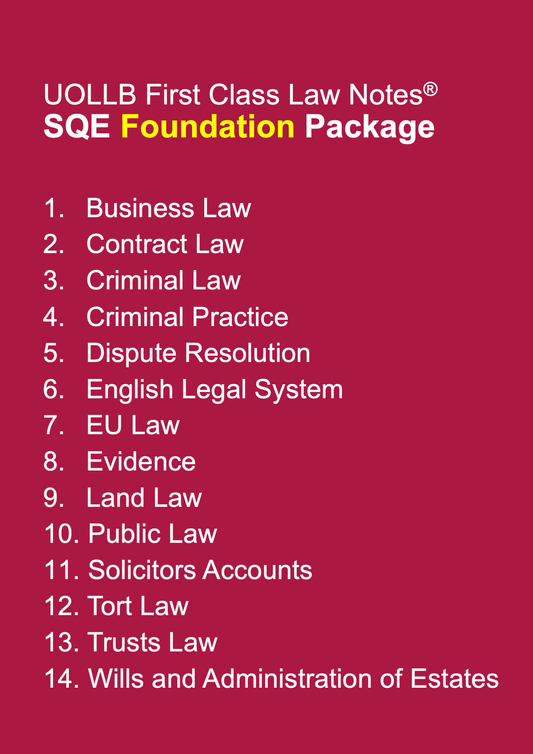

Law of Wills and Succession

Share

Law of Wills and Succession encompasses interconnected areas of law that deal with the transfer of assets and the administration of estates upon a person's death. Here are the topics you will learn in this module.

Introduction

Wills, succession, and probate are areas of law that deal with the transfer of assets and property after a person's death. These laws determine how a person's estate is distributed among their beneficiaries and provide mechanisms for ensuring the wishes of the deceased are carried out.

Intestacy

Intestacy refers to the situation where a person dies without a valid will or testament. In such cases, the distribution of the deceased's estate is governed by the laws of intestacy, which vary by jurisdiction. These laws provide a framework for distributing the assets among surviving family members according to a predetermined hierarchy of beneficiaries.

Will and Testament

A will, also known as a testament, is a legal document that outlines the wishes and instructions of a deceased person regarding the distribution of their assets and the appointment of guardians for minor children, if applicable. A will allows individuals to have control over how their estate is distributed and who will manage the process.

Formalities of Will

The formalities of a will refer to the legal requirements that must be met for a will to be considered valid. These requirements generally include the testator (the person making the will) being of sound mind, the will being in writing, the testator signing the will, and the presence of witnesses who also sign the will.

Revocation

Revocation involves the act of canceling or invalidating a will. A testator may revoke a will by executing a new will that expressly revokes the previous one, by physically destroying the will, or by making changes through a codicil (an amendment to the will). Revocation can also occur automatically in certain circumstances, such as marriage or divorce.

Construction

Construction refers to the interpretation of a will. When there are ambiguities or uncertainties in the language of a will, a court may be called upon to determine the testator's intended meaning and distribute the estate accordingly. The court's goal is to give effect to the testator's intentions as far as possible.

Family Provision

Family provision laws, also known as testamentary or inheritance provisions, provide protection for certain eligible family members or dependents who have been inadequately provided for in a will. These laws vary by jurisdiction but generally allow the court to make adjustments to the distribution of the estate to ensure reasonable financial provision for eligible individuals.

Entitlement

Entitlement refers to the rights and claims individuals have to a deceased person's estate. This can include beneficiaries named in a valid will, heirs under intestacy laws, or individuals entitled to claim under family provision laws.

Alternative Succession

Alternative succession refers to situations where the intended beneficiary of an estate predeceases the testator or is unable to inherit due to legal restrictions. In such cases, the estate may pass to alternate beneficiaries named in the will or to heirs determined by intestacy laws.

Inheritance Tax

Inheritance tax, also known as estate tax or death duty, is a tax imposed on the transfer of assets from a deceased person to their beneficiaries. The tax is typically based on the value of the estate and varies by jurisdiction. Some jurisdictions may have exemptions or thresholds for smaller estates.

Income Tax

Income tax considerations may arise during the administration of an estate, particularly when generating income from estate assets or distributing income to beneficiaries. The estate or the beneficiaries may be liable to pay income tax on applicable earnings or distributions.

Capital Gains Tax

Capital gains tax may be applicable when an estate sells or transfers assets that have appreciated in value. The tax is generally levied on the capital gains realised, which is the difference between the acquisition cost and the selling price of the asset.

The specific laws and regulations related to wills, succession, and probate can vary between jurisdictions. Additionally, tax laws and regulations, including inheritance tax, income tax, and capital gains tax, are subject to change and may have different rules and thresholds in different jurisdictions.

Introduction

Wills, succession, and probate are areas of law that deal with the transfer of assets and property after a person's death. These laws determine how a person's estate is distributed among their beneficiaries and provide mechanisms for ensuring the wishes of the deceased are carried out.

Intestacy

Intestacy refers to the situation where a person dies without a valid will or testament. In such cases, the distribution of the deceased's estate is governed by the laws of intestacy, which vary by jurisdiction. These laws provide a framework for distributing the assets among surviving family members according to a predetermined hierarchy of beneficiaries.

Will and Testament

A will, also known as a testament, is a legal document that outlines the wishes and instructions of a deceased person regarding the distribution of their assets and the appointment of guardians for minor children, if applicable. A will allows individuals to have control over how their estate is distributed and who will manage the process.

Formalities of Will

The formalities of a will refer to the legal requirements that must be met for a will to be considered valid. These requirements generally include the testator (the person making the will) being of sound mind, the will being in writing, the testator signing the will, and the presence of witnesses who also sign the will.

Revocation

Revocation involves the act of canceling or invalidating a will. A testator may revoke a will by executing a new will that expressly revokes the previous one, by physically destroying the will, or by making changes through a codicil (an amendment to the will). Revocation can also occur automatically in certain circumstances, such as marriage or divorce.

Construction

Construction refers to the interpretation of a will. When there are ambiguities or uncertainties in the language of a will, a court may be called upon to determine the testator's intended meaning and distribute the estate accordingly. The court's goal is to give effect to the testator's intentions as far as possible.

Family Provision

Family provision laws, also known as testamentary or inheritance provisions, provide protection for certain eligible family members or dependents who have been inadequately provided for in a will. These laws vary by jurisdiction but generally allow the court to make adjustments to the distribution of the estate to ensure reasonable financial provision for eligible individuals.

Entitlement

Entitlement refers to the rights and claims individuals have to a deceased person's estate. This can include beneficiaries named in a valid will, heirs under intestacy laws, or individuals entitled to claim under family provision laws.

Alternative Succession

Alternative succession refers to situations where the intended beneficiary of an estate predeceases the testator or is unable to inherit due to legal restrictions. In such cases, the estate may pass to alternate beneficiaries named in the will or to heirs determined by intestacy laws.

Inheritance Tax

Inheritance tax, also known as estate tax or death duty, is a tax imposed on the transfer of assets from a deceased person to their beneficiaries. The tax is typically based on the value of the estate and varies by jurisdiction. Some jurisdictions may have exemptions or thresholds for smaller estates.

Income Tax

Income tax considerations may arise during the administration of an estate, particularly when generating income from estate assets or distributing income to beneficiaries. The estate or the beneficiaries may be liable to pay income tax on applicable earnings or distributions.

Capital Gains Tax

Capital gains tax may be applicable when an estate sells or transfers assets that have appreciated in value. The tax is generally levied on the capital gains realised, which is the difference between the acquisition cost and the selling price of the asset.

The specific laws and regulations related to wills, succession, and probate can vary between jurisdictions. Additionally, tax laws and regulations, including inheritance tax, income tax, and capital gains tax, are subject to change and may have different rules and thresholds in different jurisdictions.