A presumed resulting trust is a type of resulting trust that arises when there is a presumption or inference that the legal owner of property holds it for the benefit of another person. In a presumed resulting trust, the beneficiary must prove that they have a beneficial interest in the property, but they do not need to prove an express agreement or intention to create a trust.

A presumed resulting trust may arise in a number of situations, including:

- Where a person pays for property but puts the title in someone else's name. In such a case, the presumption is that the legal owner holds the property on trust for the person who paid for it.

- Where a person transfers property to someone else without receiving adequate consideration, or without intending to make a gift. In such a case, the presumption is that the legal owner holds the property on trust for the person who transferred it.

- Where a person contributes to the purchase or improvement of property that is held in joint names, but their contribution is not reflected in the legal title. In such a case, the presumption is that the legal owners hold the property on trust for all the contributors, in proportion to their contributions.

In order to establish a presumed resulting trust, the beneficiary must provide evidence to support the presumption, which may include evidence of contributions, financial transactions, or other relevant circumstances.

The presumption of a resulting trust is a rebuttable presumption, which means that the legal owner may be able to provide evidence to rebut the presumption and establish that they hold the property for their own benefit.

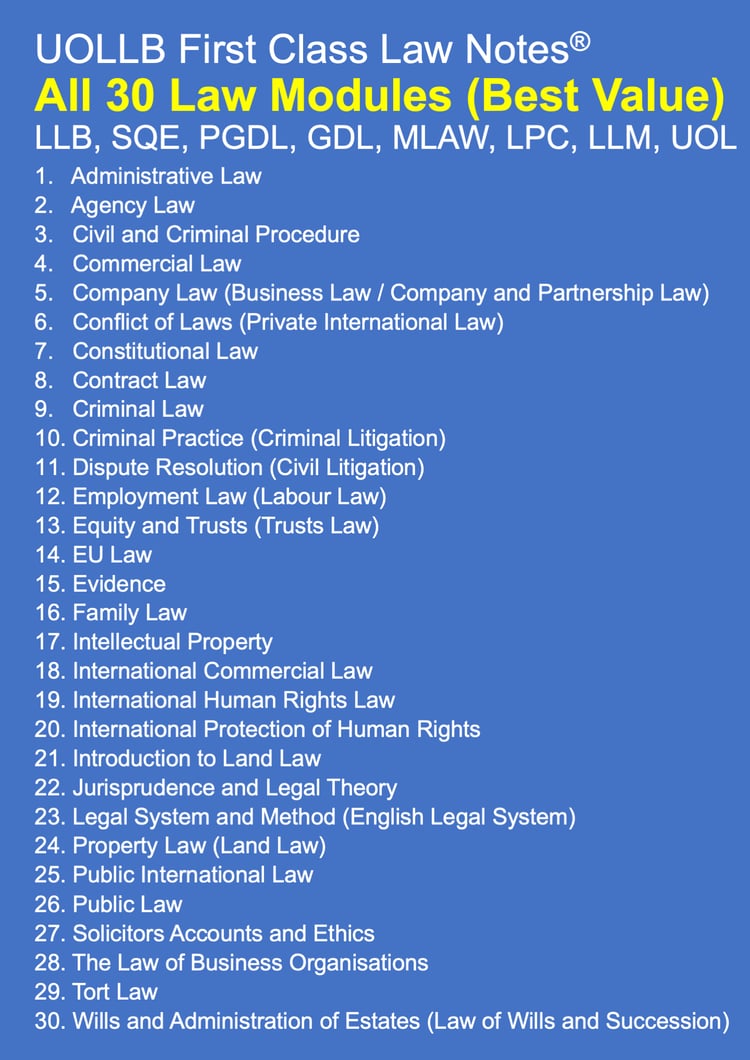

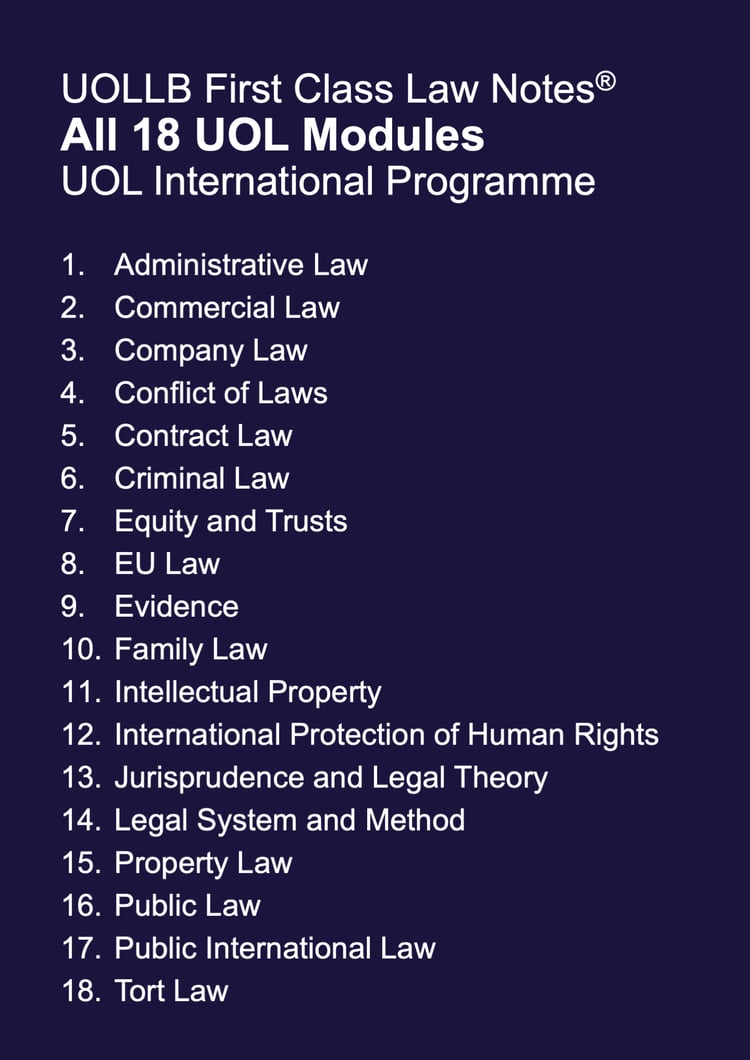

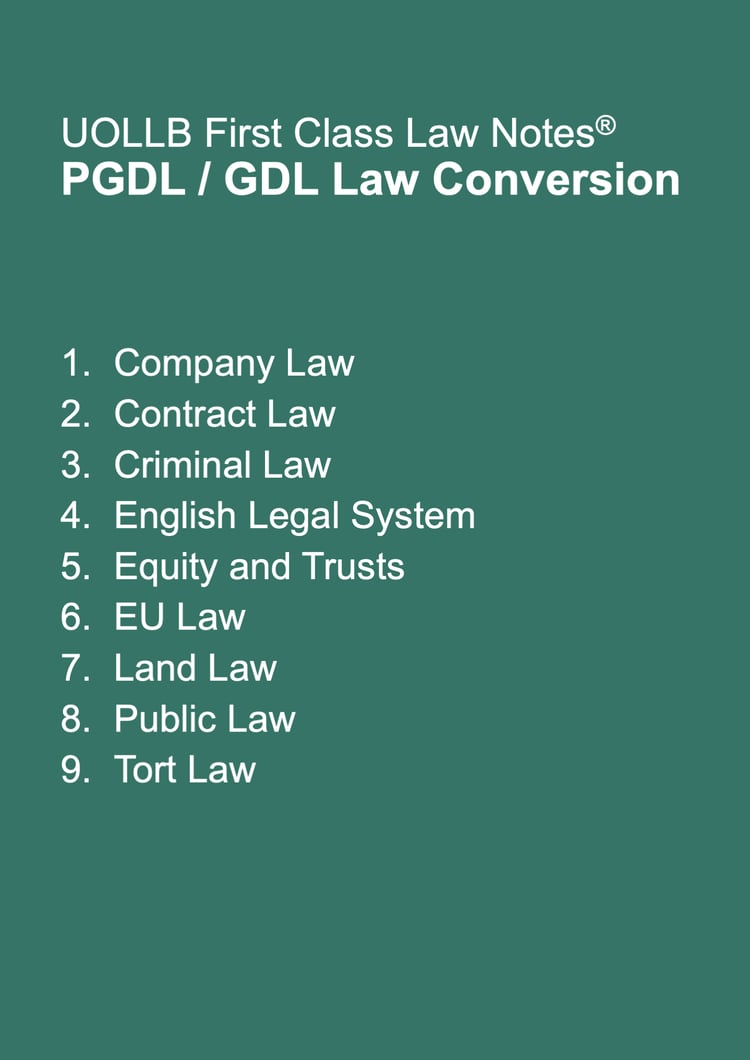

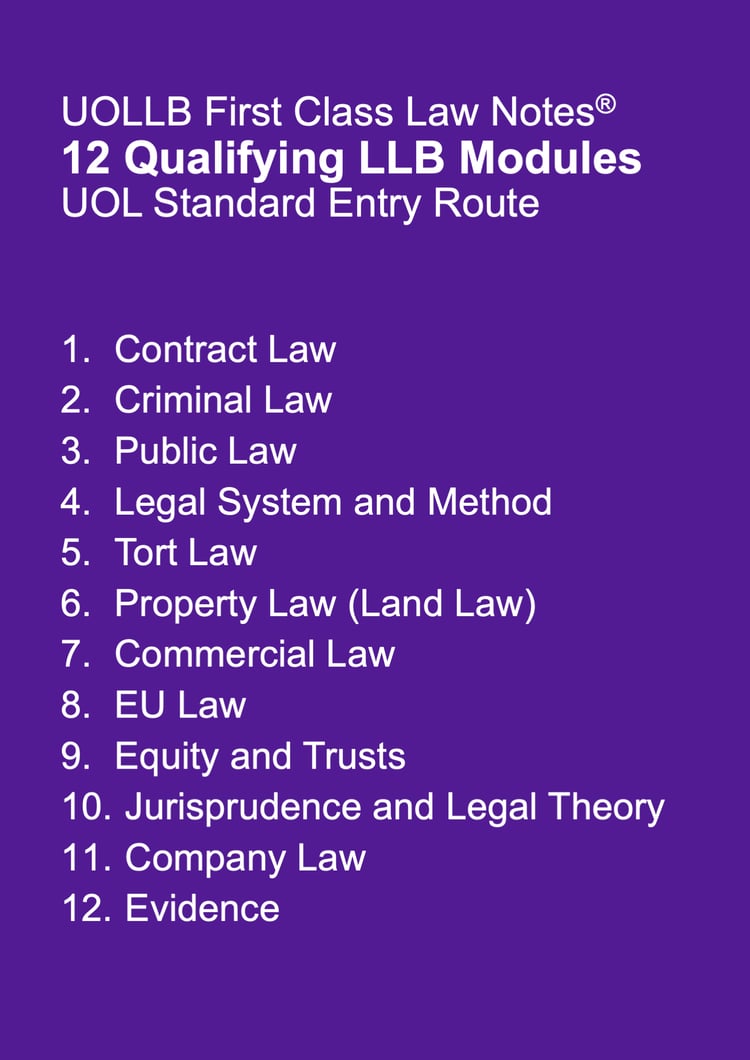

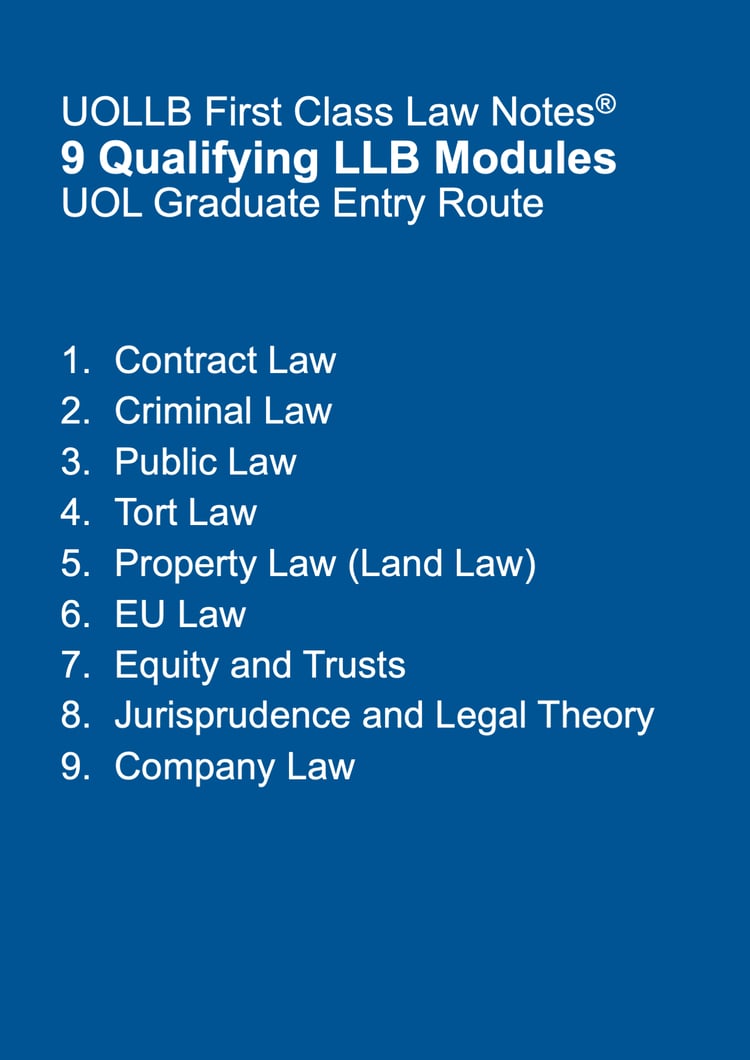

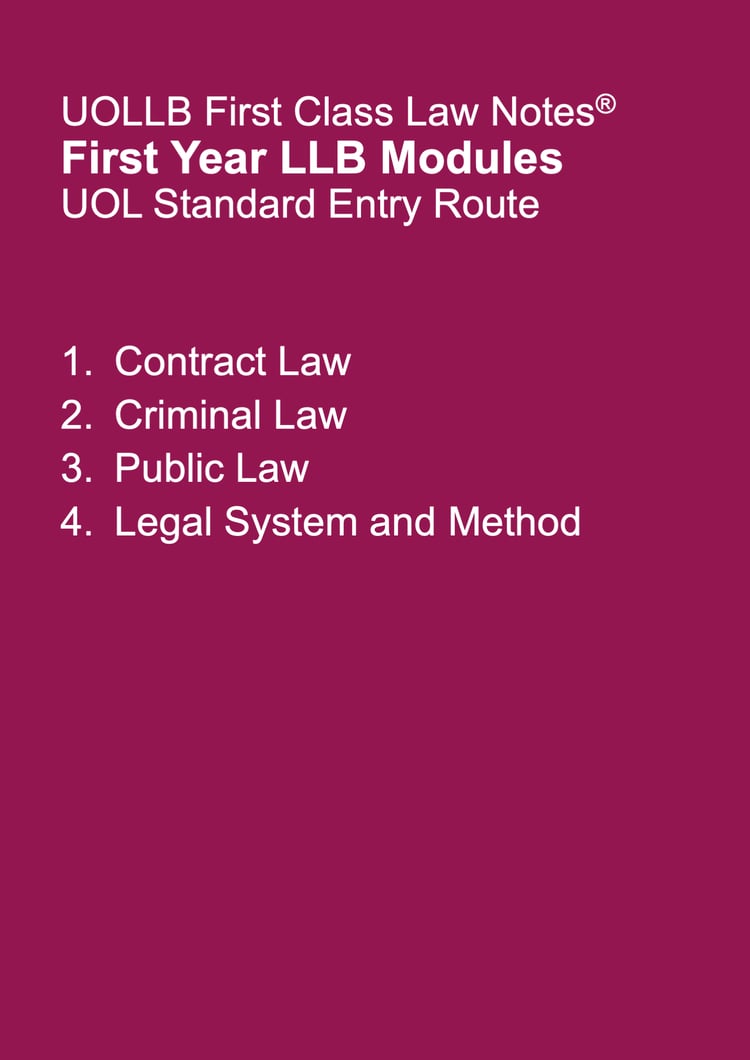

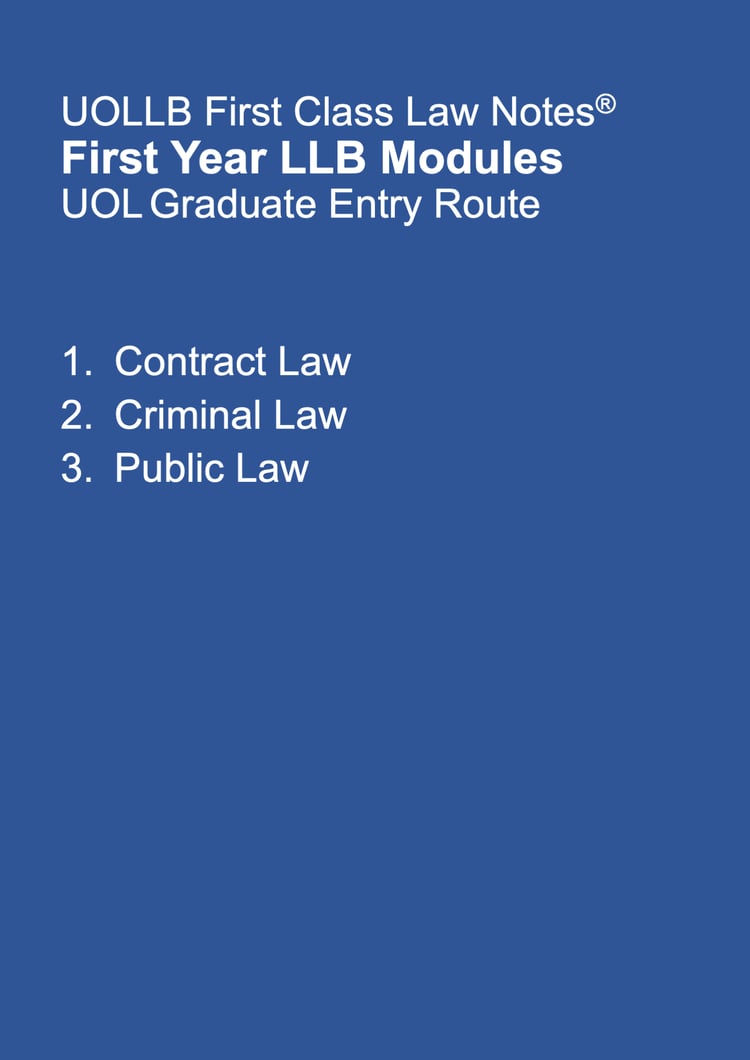

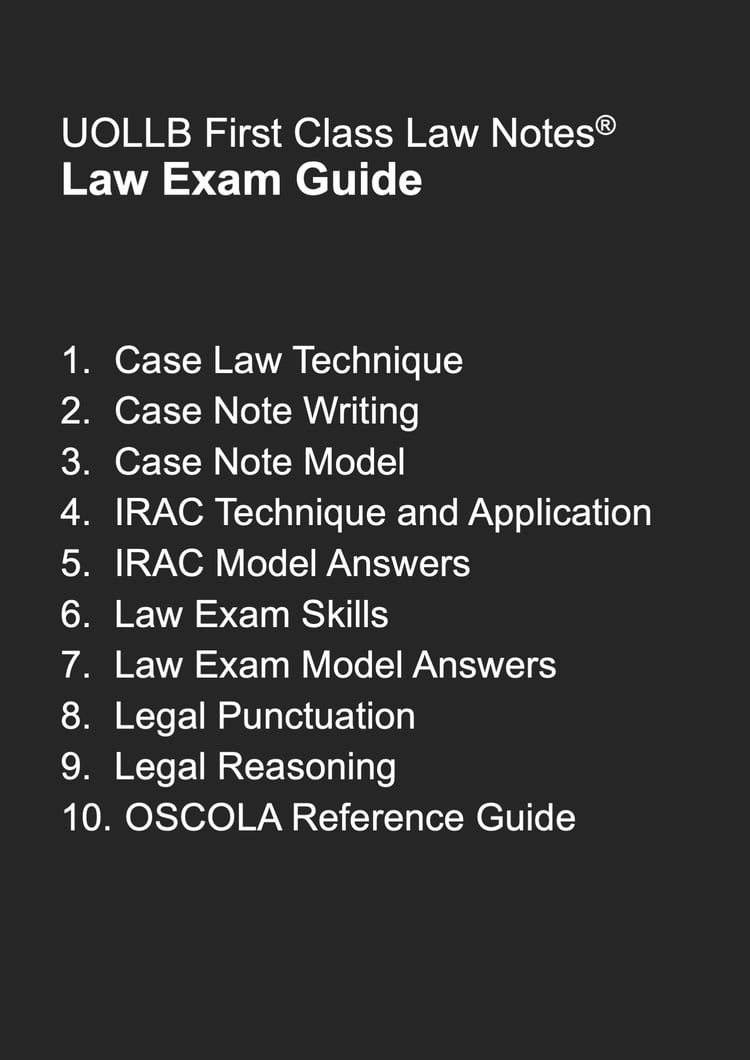

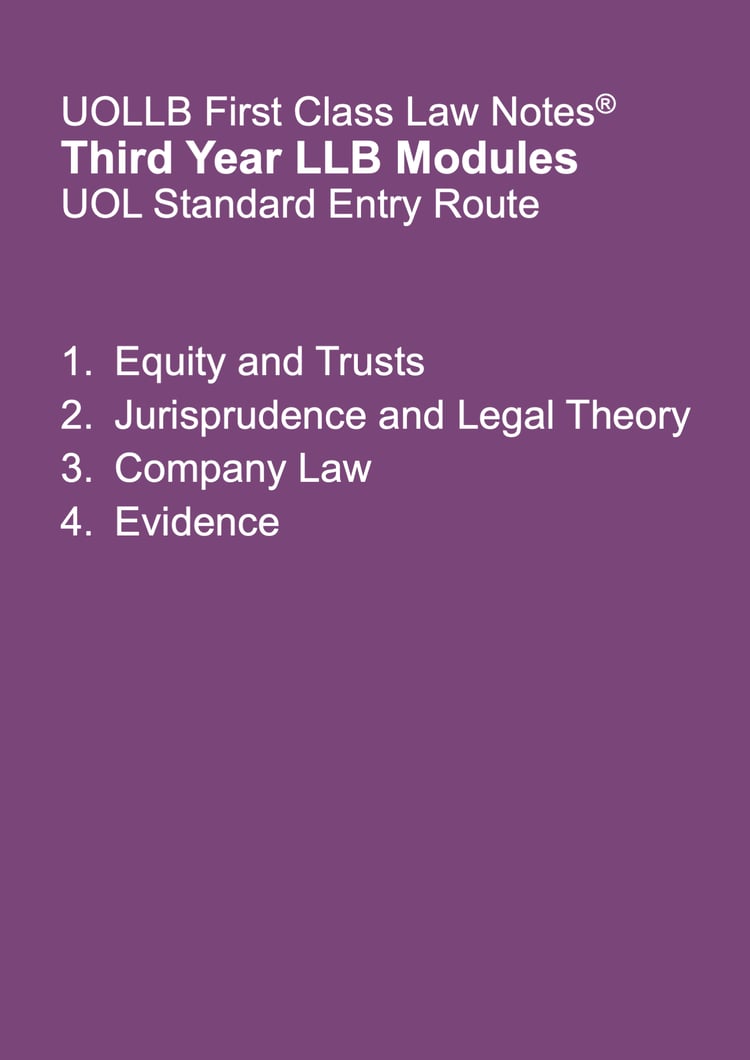

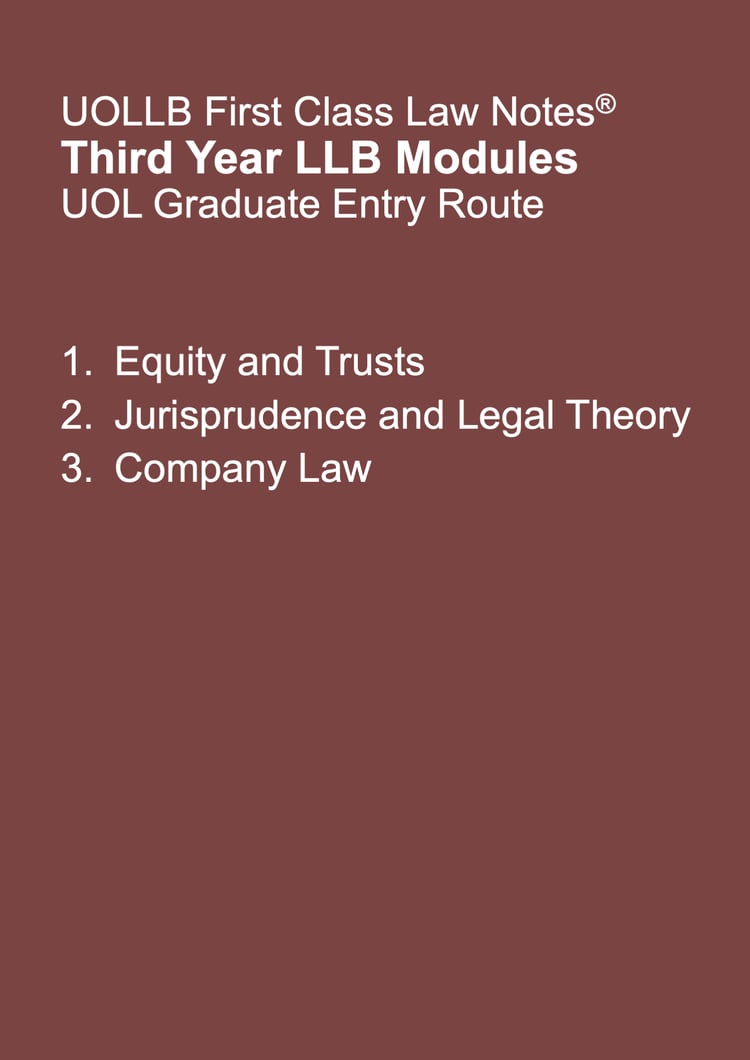

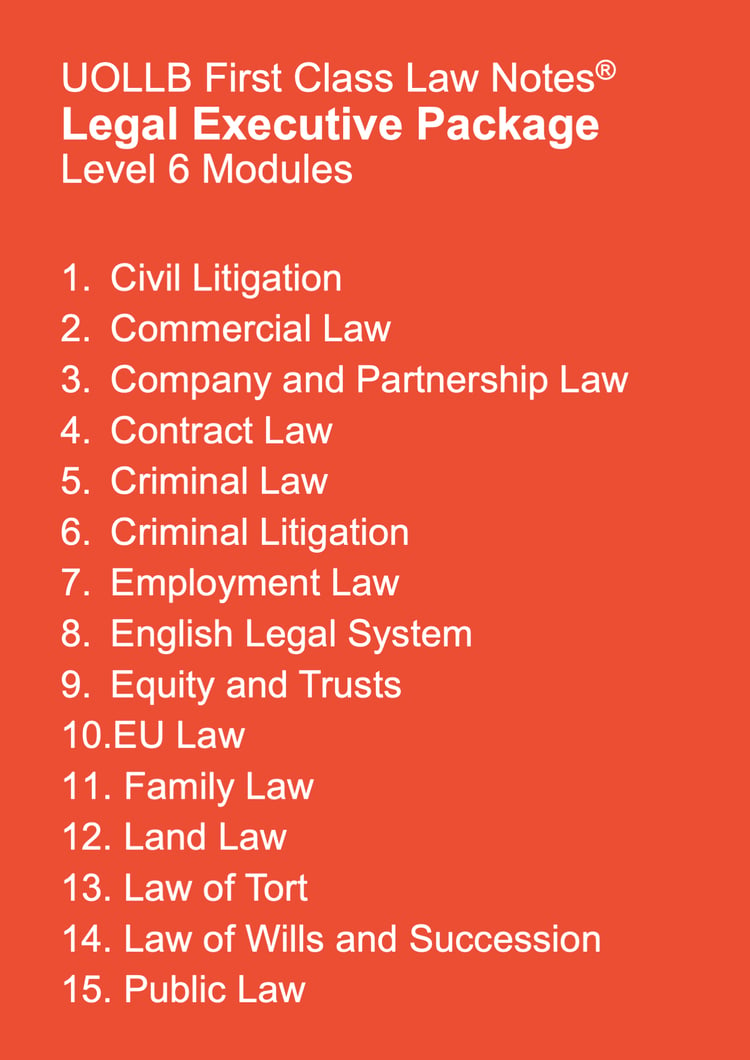

You can learn more about this topic and relevant case law with our Equity and Trusts notes.