Company Law governs the formation, operation, and dissolution of companies or corporations and provides rules and regulations for how companies should be structured, managed, and regulated. You can select this module in Year 3. Although it is not required for entry into bar training, it is heavily assessed in the SQE for intending solicitors. Here is a summary of the topics covered in this module.

The Nature of Legal Personality: Legal personality refers to the recognition of a company as a separate entity from its shareholders or members. It grants the company certain rights, obligations, and legal standing in its own right. This means that the company can own property, enter into contracts, and sue or be sued in its own name.

Lifting the Veil of Incorporation: Lifting the veil of incorporation is a legal doctrine that allows the courts to disregard the separate legal personality of a company and hold its shareholders or directors personally liable for the company's actions or debts. This is typically done when the company is being used to commit fraud, evade legal obligations, or unfairly harm third parties.

Incidents of Corporate Personality: Incidents of corporate personality are the legal rights and responsibilities that come with the separate legal personality of a company. These include limited liability for shareholders, perpetual succession, capacity to own property, ability to enter into contracts, and the right to sue and be sued.

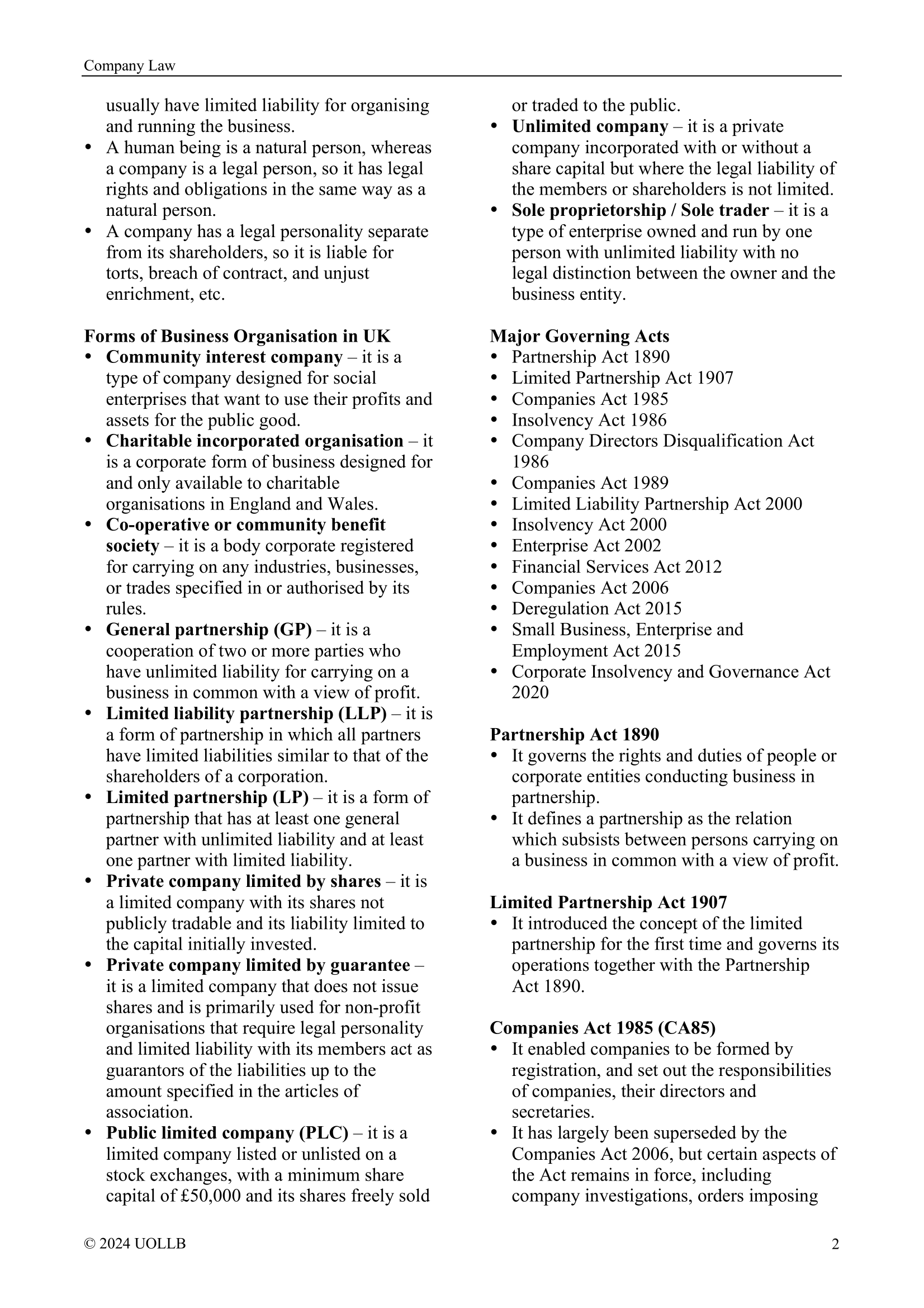

Differences between Incorporated and Unincorporated Associations: Incorporated associations are legal entities that have obtained registration with the relevant government authority, granting them separate legal personality. They enjoy the benefits of limited liability and other legal rights. By contrast, unincorporated associations do not have separate legal personality and their members may be personally liable for the association's actions and debts.

The Rule in Salomon v Salomon & Co Ltd: The rule in Salomon v Salomon & Co Ltd is a landmark legal case that established the principle of separate legal personality for companies. It held that once a company is incorporated, it becomes a distinct legal entity separate from its shareholders, and the liabilities of the company are separate from those of its shareholders.

The Development of the Rule in Salomon v Salomon & Co Ltd: The rule in Salomon v Salomon & Co Ltd has been generally followed and upheld in common law jurisdictions. However, there have been some limited exceptions and instances where the courts have pierced the corporate veil, such as in cases of fraud, improper conduct, or to prevent injustice. These exceptions have developed over time through subsequent court decisions.

Tortious Liability as an Alternative to Veil Lifting: Instead of lifting the veil of incorporation, it is possible to hold the company directly liable for its actions through tortious liability. In such cases, the injured party can sue the company itself for damages caused by its wrongful acts or negligence, rather than seeking to hold the shareholders personally liable.

The Formation of the Company: The formation of a company involves several steps, such as selecting a company name, preparing the company's constitution (articles of association), appointing directors and shareholders, and registering the company with the relevant government authority. This process typically requires compliance with legal requirements, including submission of documents and payment of fees.

The Suitability of the Company as a Legal Vehicle for Different Types of Business: The company structure offers benefits such as limited liability, perpetual succession, and ease of transferring ownership. It is well-suited for businesses that require substantial investment, want to limit the liability of their owners, or plan for long-term existence. However, the regulatory and compliance obligations of companies may make them less suitable for small, simple businesses or those with specific tax or operational preferences.

The Process of Company Registration: The process of company registration involves submitting the necessary documents, such as the company's constitution, details of directors and shareholders, and paying the required fees to the appropriate government authority. Once the application is approved, the company is officially registered and receives a certificate of incorporation, which confirms its separate legal personality. Registration also triggers various legal obligations, such as filing annual returns and financial statements, and complying with corporate governance requirements.

The Memorandum and Articles of Association: The memorandum of association is a legal document that sets out the company's name, registered office, objectives, and capital structure. It defines the company's external relationships and acts as its constitution. The articles of association contain internal rules and regulations governing the company's internal management, including the rights and duties of shareholders, directors, and other officers.

Pre-incorporation Contracts: Pre-incorporation contracts are agreements entered into on behalf of a company before it is officially incorporated. Since the company does not exist at the time of entering into these contracts, the individuals or promoters who negotiate and sign them become personally liable. Once the company is incorporated, it may choose to adopt or ratify these contracts, thereby assuming the rights and obligations.

The Duties and Liabilities of Promoters: Promoters are individuals who take the initiative in forming a company and are involved in its promotion and organization. They owe fiduciary duties to the company, including the duty of good faith, loyalty, and disclosure. Promoters can be held personally liable for any profits made from their dealings with the company, and they must act in the best interests of the company and disclose any conflicts of interest.

The Relations between the Company and Outsiders: The company has its own legal personality, separate from its shareholders and directors. Therefore, the company is responsible for its own debts and obligations. Outsiders who enter into contracts with the company can hold the company liable for its actions, and the company can sue or be sued in its own name.

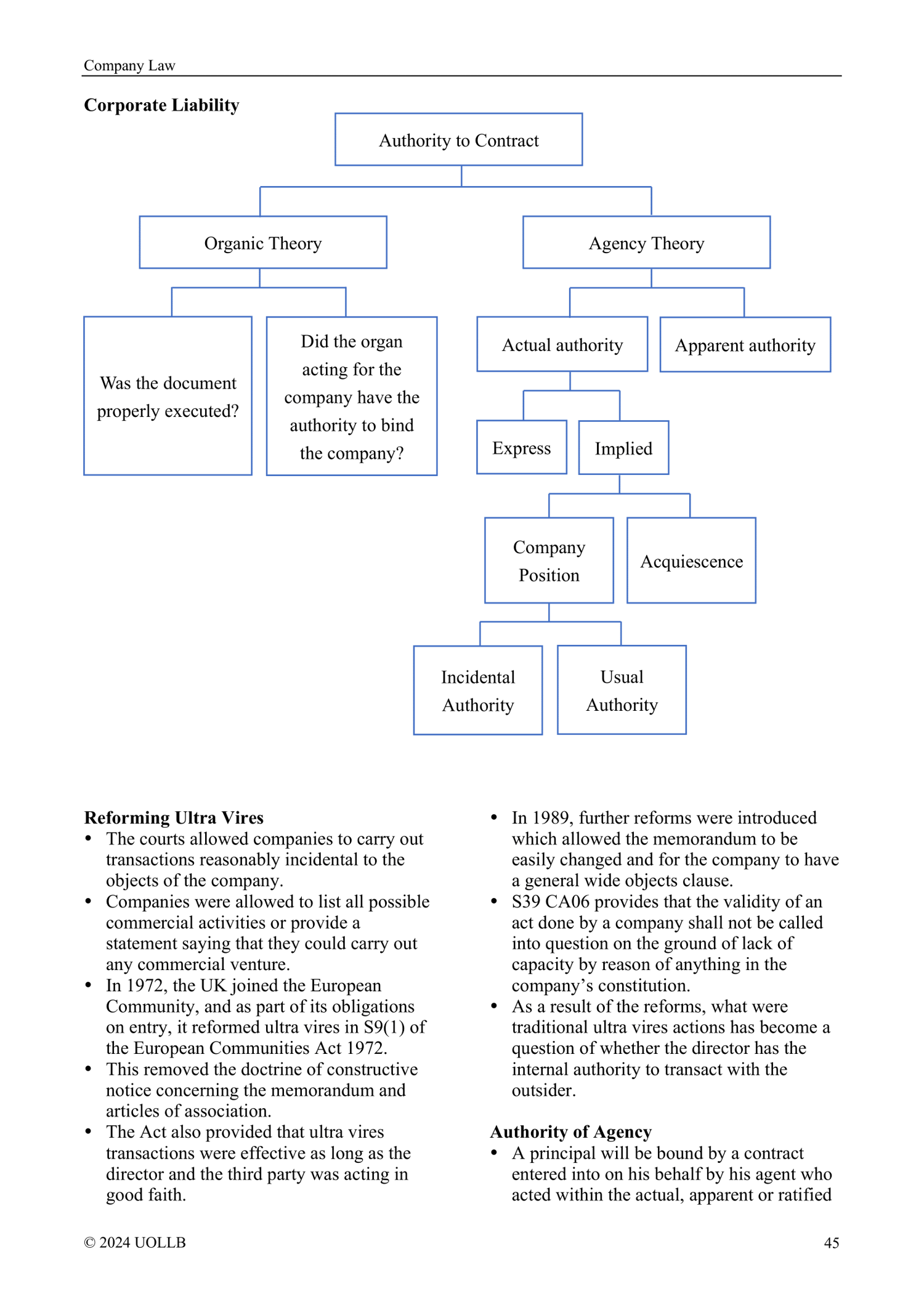

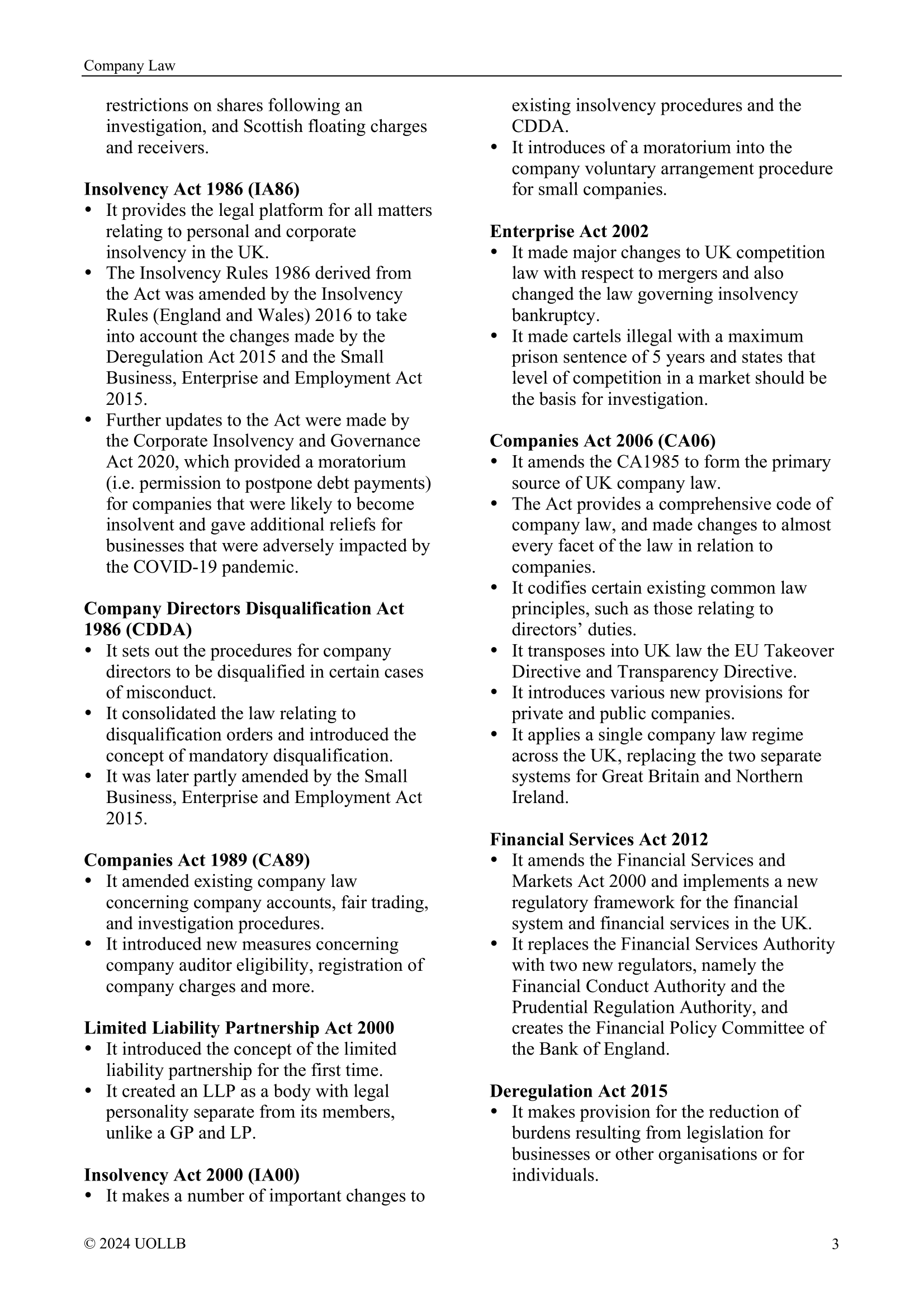

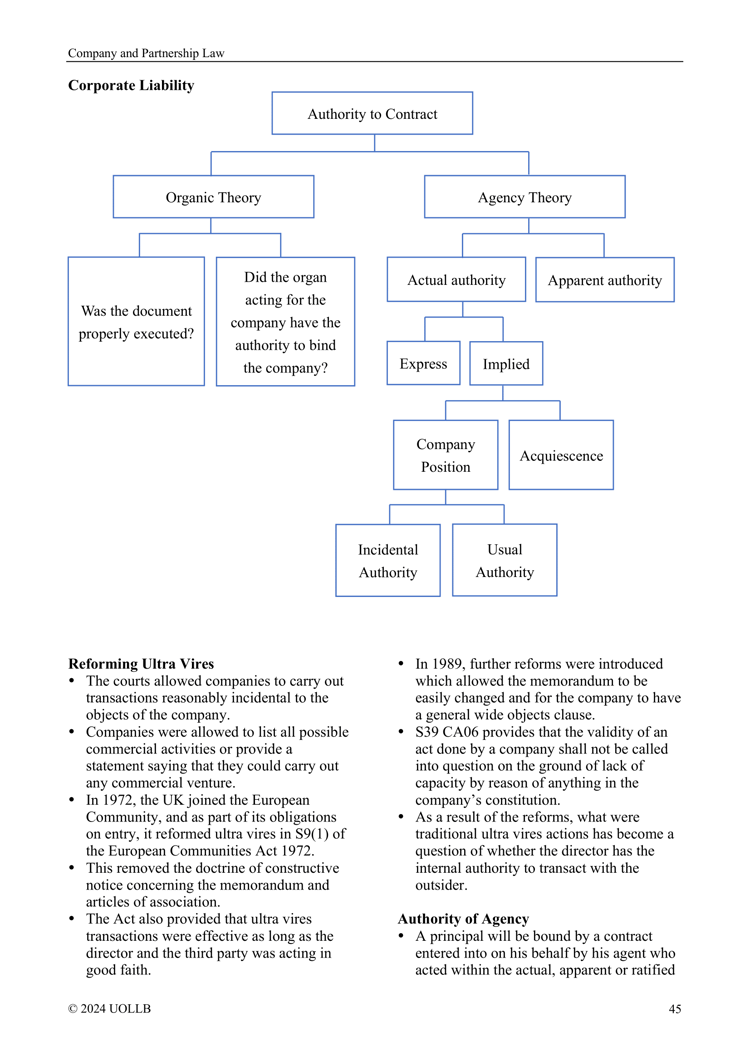

The Growth and Decline of the Doctrines of Ultra Vires: The doctrine of ultra vires refers to actions or transactions that are beyond the powers or objectives of a company as stated in its memorandum of association. Historically, ultra vires acts were considered void and unenforceable. However, this strict doctrine has gradually declined, and most jurisdictions now allow companies to engage in activities reasonably incidental to their main objectives.

Constructive Notice: Constructive notice is a legal concept that deems individuals to have knowledge of certain facts or information even if they do not actually possess that knowledge. In the context of company law, the doctrine of constructive notice holds that anyone dealing with a company is deemed to have knowledge of its publicly available documents, such as its memorandum and articles of association.

The Turquand Rule: The Turquand rule, also known as the indoor management rule, provides protection to third parties who have entered into contracts with a company. It states that outsiders dealing with a company are entitled to assume that the company's internal procedures, such as the authority of directors or the validity of resolutions, have been properly followed, unless they have notice to the contrary.

The Application of Principles of Agency: Company law often applies principles of agency, whereby directors and officers act as agents of the company. The company is bound by the actions of its directors and officers within their authority. However, the principles of agency can also impose personal liability on directors and officers if they exceed their authority or act in breach of their duties.

The Commission of Crimes and Torts by the Company: Companies can be held liable for criminal offences and tortious acts committed by their employees, officers, or agents within the scope of their employment or authority. The company can be prosecuted or sued for such actions, and may be subject to fines, penalties, or civil liabilities.

Vicarious Liability: Vicarious liability is the legal principle that holds one party responsible for the actions or omissions of another party. In the context of company law, vicarious liability can arise when an employee, officer, or agent of a company commits a tort or wrongdoing while acting in the course of his employment or within his authority. The company can be held vicariously liable for the actions of its employees or agents, even if the company itself did not participate in or have knowledge of the wrongdoing. This means that the injured party can hold the company liable for the actions of its employees or agents, seeking compensation or damages.

The Alter Ego Doctrine: The alter ego doctrine is a legal concept that allows the courts to disregard the separate legal personality of a company and treat it as the alter ego or mere extension of its controlling shareholders or directors. This doctrine is typically applied in situations where the company is used for fraudulent or improper purposes, or where there is an abuse of the corporate form to evade legal obligations or hide wrongdoing.

The Relations between the Company and Its Members and among the Members Inter Se: The relationship between the company and its members is governed by the company's constitution, which includes the memorandum and articles of association. The company owes certain rights and duties to its members, such as providing them with information, holding meetings, and distributing dividends. Among the members themselves, there may be agreements, rights, and obligations that exist outside the company's constitution, such as shareholder agreements or specific rights attached to different classes of shares.

The Statutory Contract between the Company and Its Members: The statutory contract between the company and its members is created when a person becomes a member of the company. It is an essential part of the relationship between the company and its members and is governed by company law statutes. The statutory contract includes the rights and obligations of the members and the company, as well as the rules for transferring shares, voting rights, and the distribution of profits.

Different Capacities of Members: Members of a company may have different capacities, depending on the type of shares they hold or the roles they have within the company. For example, some members may be ordinary shareholders, while others may be preference shareholders with specific rights regarding dividends or liquidation. Additionally, members may also hold positions as directors or officers of the company, which may come with additional rights and responsibilities.

Relations between One Member and Another: The relations between members of a company are typically governed by the company's constitution, any shareholder agreements, and applicable laws. These relations may involve matters such as voting rights, profit sharing, decision-making, and restrictions on the transfer of shares. Disputes between members may be resolved through internal dispute resolution mechanisms, such as mediation or arbitration, or through legal proceedings if necessary.

Alteration of the Statutory Contract: The statutory contract between the company and its members can be altered through various means, such as amendments to the company's constitution or changes in the rights and obligations of members as provided by the law. Any alteration to the statutory contract usually requires compliance with legal procedures, such as passing special resolutions or obtaining the consent of a specified majority of the members.

Remedies for Breach of the Statutory Contract: If there is a breach of the statutory contract between the company and its members, the aggrieved party may seek remedies through legal means. This may include seeking specific performance, damages, or injunctions to prevent further breaches. The specific remedies available will depend on the nature of the breach and the applicable laws and regulations.

Management of the Company: The management of a company is typically entrusted to its directors and officers, who are responsible for making decisions and carrying out the day-to-day operations of the company. The directors owe fiduciary duties to the company and must act in the best interests of the company and its members. The company's constitution and applicable laws outline the powers and duties of the directors, as well as the mechanisms for appointing and removing directors. Members may also have certain rights to participate in the management, such as voting on important matters or electing directors.

Directors and Other Officers: Directors are individuals appointed to manage and oversee the affairs of a company on behalf of its shareholders. They have fiduciary duties to act in the best interests of the company, exercise reasonable care, and avoid conflicts of interest. Other officers, such as the CEO, CFO, or company secretary, may also be appointed to carry out specific functions and responsibilities within the company.

Appointment of Directors: Directors are typically appointed by the shareholders of the company. The process for appointment may be outlined in the company's constitution or governed by applicable laws and regulations. Shareholders may appoint directors through resolutions passed at general meetings or through written resolutions. In some cases, directors may also be appointed by other directors or by specific classes of shareholders.

Retirement of Directors: Directors may retire from their positions voluntarily or in accordance with the provisions of the company's constitution. The retirement process may involve notifying the company and shareholders of the intention to retire and ensuring a smooth transition of responsibilities. Companies may also set age limits or term limits for directors' tenure, requiring them to retire at a certain age or after a specified period.

Dismissal of Directors: Directors may be dismissed or removed from their positions by shareholders or by a resolution of the board of directors. The process for dismissal is typically governed by the company's constitution or by applicable laws and regulations. Shareholders may have the power to remove directors by passing an ordinary resolution or a special resolution at a general meeting. In some cases, shareholders may also have the right to remove directors for cause or in specific circumstances outlined in the company's constitution.

Disqualification of Directors: Directors can be disqualified from holding office if they are found to be in breach of certain legal requirements or if they engage in misconduct. Disqualification may result from actions such as fraudulent conduct, involvement in wrongful trading, or failure to comply with statutory obligations. The specific grounds and procedures for disqualification vary among jurisdictions, but generally aim to protect the interests of the company and its stakeholders.

Meetings: Meetings are an important mechanism for decision-making and communication within a company. They may include general meetings of shareholders and board meetings of directors. Meetings provide opportunities for discussion, voting on resolutions, and sharing information. Proper notice and procedures must be followed to convene and conduct meetings in accordance with the company's constitution and applicable laws.

Voting: Voting allows shareholders and directors to express their preferences, make decisions, and elect individuals to positions of authority. Each share typically carries a certain number of votes, and shareholders may exercise their voting rights in person, by proxy, or through written resolutions. Voting may be used to elect directors, approve resolutions, amend the company's constitution, or make other important decisions.

Resolutions: Resolutions are formal decisions made by the company, its shareholders, or its directors. Resolutions may be passed at general meetings, board meetings, or through written resolutions. They can relate to a variety of matters, such as approving financial statements, declaring dividends, authorising transactions, or making changes to the company's constitution. Resolutions may require a specific majority or unanimity to be valid.

Division of Functions among Officers and Organs of the Company: Within a company, various officers and organs may have different functions and responsibilities. Directors are responsible for the overall management and strategic decisions of the company, while other officers may handle specific areas such as finance, operations, or legal compliance. The division of functions among officers and organs is typically determined by the company's constitution, organisational structure, and the specific roles assigned to individuals within the company.

The General Duties of Directors: Directors have a range of general duties that they owe to the company and its stakeholders. These duties typically include acting in good faith and in the best interests of the company, exercising reasonable care, skill, and diligence, avoiding conflicts of interest, promoting the success of the company, and complying with legal and regulatory requirements. Directors are expected to act with honesty, integrity, and in a manner that promotes the long-term sustainability and prosperity of the company.

The Codification of Directors' Duties: In many jurisdictions, directors' duties have been codified in company law statutes or corporate governance codes. These codifications provide a clear framework for directors to understand and fulfil their obligations. For example, the Companies Act in the United Kingdom and the Corporations Act in Australia outline specific duties and responsibilities of directors.

Statutory Controls on Directors: Company law statutes often impose certain controls and regulations on directors to protect the interests of shareholders and stakeholders. These controls may include requirements for disclosure of conflicts of interest, restrictions on self-dealing transactions, limitations on the exercise of powers, and mechanisms for shareholder oversight and accountability.

Rules on Self-dealing: Self-dealing refers to situations where directors engage in transactions or activities that involve conflicts of interest with the company. Such conflicts may arise when directors have personal financial interests or relationships that could influence their decision-making. Company law often imposes strict rules on self-dealing, requiring directors to disclose their interests and obtain approval from the board or shareholders for such transactions.

Criminalisation of Insider Trading: Insider trading involves the buying or selling of securities based on non-public, material information. Many jurisdictions have criminalised insider trading, making it illegal for directors or any individuals with access to confidential company information to trade in securities based on that information. Insider trading laws aim to ensure fairness, transparency, and integrity in financial markets.

The Enforcement of Directors' Duties: The enforcement of directors' duties can occur through various mechanisms. Shareholders, regulators, or other stakeholders may take legal action against directors for breach of their duties. Remedies may include damages, injunctions, or the removal of directors from office. In some cases, directors may also face personal liability, fines, or disqualification from acting as directors.

Rule in Foss v Harbottle: The rule in Foss v Harbottle is a legal principle that limits shareholders' ability to bring a claim against directors for wrongs done to the company. It states that where a wrong is done to the company, the proper plaintiff is the company itself, and the claim should be brought by the company through its board or shareholders collectively. The rule aims to prevent multiple or duplicative claims and to ensure that the company, as a separate legal entity, takes action to protect its interests.

Statutory Derivative Claim: In some jurisdictions, statutory provisions allow shareholders to bring derivative claims on behalf of the company against directors for breaches of duty or other wrongs. This provides a mechanism for shareholders to seek redress for harm caused to the company when the board fails to take appropriate action. The statutory derivative claim enables shareholders to bring a claim in the name of the company, bypassing the restrictions of the rule in Foss v Harbottle.

Company Disclosure: Company disclosure refers to the requirement for companies to provide accurate and timely information about their financial position, performance, and other material matters. This includes disclosing financial statements, annual reports, director's reports, and other relevant information to shareholders, regulators, and the public. Company disclosure promotes transparency, accountability, and informed decision-making by shareholders and other stakeholders.

Investigations by the Department for Business, Energy, and Industrial Strategy: The Department for Business, Energy, and Industrial Strategy (BEIS) in the UK has the power to conduct investigations into the affairs of companies. These investigations are carried out to ensure compliance with company law, identify any misconduct, or address concerns about the company's operations. BEIS may initiate investigations based on various triggers, such as complaints from stakeholders, concerns raised by regulatory bodies, or suspicions of wrongdoing. During an investigation, BEIS has the authority to request information, interview individuals, and examine company records. If wrongdoing is found, BEIS may take enforcement action, such as imposing fines, disqualifying directors, or initiating legal proceedings.

The Protection of Minority Shareholders: Minority shareholders are individuals or entities that hold a minority stake in a company and have less control and influence compared to majority shareholders. To safeguard their rights and interests, regulators often provide mechanisms for the protection of minority shareholders. These mechanisms may include statutory provisions, such as the right to access information, the right to participate in decision-making, the right to fair treatment in corporate actions, and the right to bring legal actions against the company or majority shareholders in case of oppression or prejudicial conduct.

The Statutory Remedies for the Protection of Minority Shareholders: Statutory remedies are legal provisions that allow minority shareholders to seek redress when their rights or interests are infringed upon. These remedies can include derivative actions, which allow minority shareholders to bring legal claims on behalf of the company for the benefit of all shareholders, and oppression remedies, which provide minority shareholders with recourse against oppressive or unfairly prejudicial actions by the majority shareholders or the company itself. These statutory remedies aim to provide an avenue for minority shareholders to challenge unfair practices and protect their rights.

Shareholders' Personal Rights: Shareholders possess certain personal rights that arise from their ownership of shares in a company. These rights may include the right to attend and vote at general meetings, the right to receive dividends, the right to transfer shares, the right to inspect company records, and the right to participate in the distribution of assets in the event of liquidation. These personal rights ensure that shareholders have a voice in the company's affairs and allow them to exercise their ownership rights and protect their investment.

Corporate Governance: Corporate governance refers to the system of rules, practices, and processes by which companies are directed and controlled. It encompasses the relationships between a company's management, board of directors, shareholders, and other stakeholders. Effective corporate governance promotes transparency, accountability, and ethical behaviour, and aims to ensure that companies are managed in the best interests of shareholders and stakeholders.

Corporate Accountability: Corporate accountability refers to the responsibility of companies to be answerable for their actions and decisions. It involves ensuring that companies act in accordance with legal and ethical standards, fulfil their obligations to shareholders and stakeholders, and are transparent and accountable in their reporting and disclosures. Corporate accountability mechanisms may include regular financial reporting, independent audits, shareholder activism, and regulatory oversight.

Stakeholder v Shareholder: Stakeholder and shareholder issues revolve around the balance of interests between different groups affected by a company's operations. Shareholders typically prioritise maximising shareholder value and returns on investment, while stakeholders encompass various groups affected by a company's activities, including employees. Conflicts can arise when the interests of shareholders and stakeholders diverge, leading to debates on issues such as corporate social responsibility, sustainability, and the distribution of profits. Balancing the interests of shareholders and stakeholders can be challenging, as decisions impacting one group may have implications for others. The increasing focus on corporate social responsibility and sustainability has prompted a greater recognition of stakeholder interests and the need to address these concerns alongside shareholder value creation.

Problems Arising from the Separation of Ownership and Control: In many companies, ownership and control are separated, with shareholders owning the company but delegating control to the board of directors and management. This separation can lead to agency problems, where managers may prioritise their own interests over those of the shareholders. Agency problems can result in conflicts of interest, inefficient decision-making, and a lack of accountability. Corporate governance mechanisms, such as board oversight, performance incentives, and shareholder engagement, aim to mitigate these problems and align the interests of managers with those of shareholders.

Executive Compensation: Executive compensation refers to the remuneration and benefits provided to top executives and senior management within a company. The issue of executive compensation has drawn attention due to concerns about excessive pay, lack of alignment with company performance, and the potential for conflicts of interest. Shareholders and stakeholders have become increasingly interested in ensuring that executive compensation is fair, transparent, and linked to performance metrics that align with long-term company goals.

Shareholder Engagement: Shareholder engagement involves the active participation and interaction between shareholders and the company. It allows shareholders to express their views, concerns, and expectations regarding the company's strategy, governance, performance, and sustainability. Shareholder engagement mechanisms can include attending general meetings, submitting proxy votes, engaging in dialogue with company management, participating in shareholder advisory votes, and advocating for changes or improvements in corporate practices. Effective shareholder engagement promotes transparency, accountability, and responsiveness from companies, and enhances the alignment of shareholder and company interests.

The Role of Hostile Takeovers in Disciplining Management: Hostile takeovers refer to the acquisition of a target company without the support or cooperation of its management or board. Hostile takeovers can serve as a disciplinary mechanism by providing an external check on underperforming or entrenched management. The threat of a takeover can incentivise managers to improve performance, enhance shareholder value, and be more responsive to shareholders' interests. Hostile takeovers can also lead to changes in corporate governance and management practices, as acquiring companies often seek to restructure and improve the target company's operations.

Reforming the Role and Composition of Boards: There have been ongoing discussions and reforms aimed at enhancing the role and composition of corporate boards. This includes promoting board independence, diversity, and expertise to ensure effective oversight and decision-making. Reforms may include establishing minimum representation of independent directors, increasing diversity in terms of gender, ethnicity, and skills, and strengthening board evaluation processes. These reforms aim to enhance board effectiveness, accountability, and alignment with shareholder and stakeholder interests.

Corporate Governance Codes: Corporate governance codes provide guidelines and principles for companies to follow in their governance practices. In the UK, the primary corporate governance codes include the UK Corporate Governance Code (formerly known as the Combined Code) and the Stewardship Code. These codes set out best practices and expectations related to board composition, director accountability, risk management, shareholder engagement, and other aspects of corporate governance. Compliance with these codes is often voluntary, but listed companies are expected to disclose their adherence to these principles.

The UK Corporate Governance Code: The UK Corporate Governance Code is a set of principles and best practices that guide the governance of listed companies in the UK. It covers areas such as board leadership, effectiveness, accountability, remuneration, and relations with shareholders. The code is periodically reviewed and updated by the Financial Reporting Council, taking into account evolving market conditions and stakeholder expectations. The code aims to promote transparency, integrity, and responsible governance practices within UK companies.

The Stewardship Code: The Stewardship Code in the UK sets out principles and expectations for institutional investors' engagement with the companies. It encourages investors to actively exercise their ownership rights, engage with boards, and promote long-term value creation. The Stewardship Code seeks to foster a culture of responsible and accountable stewardship by institutional investors, emphasising their role in influencing company strategy, governance, and sustainability practices.

The Company Law Review Steering Group: The Company Law Review Steering Group was a body established in the UK in 1998 to conduct a comprehensive review of company law. Its objective was to modernise and simplify company law, taking into account changing business practices, market conditions, and stakeholder interests. The group consisted of experts from academia, business, legal professions, and regulatory bodies. Its recommendations and findings led to the enactment of the Companies Act 2006, which introduced significant reforms to UK company law, including provisions related to directors' duties, shareholder rights, and corporate governance.

Shares: Shares represent ownership interests in a company and are a form of equity capital. Shareholders who hold shares in a company are considered owners and have certain rights, such as voting rights, the right to receive dividends, and the right to participate in the distribution of assets in case of liquidation. Shares can be classified into different types, such as ordinary shares and preference shares, each with its own set of rights and characteristics.

Debentures: Debentures are a form of debt instrument issued by a company to raise capital. They represent a loan made by investors to the company, and the company agrees to repay the principal amount along with interest over a specified period. Debenture holders are creditors of the company and have priority over shareholders in case of liquidation. Debentures can be secured or unsecured and may have different terms and conditions depending on the agreement between the company and the debenture holders.

Differences between Shares and Debentures: The main difference between shares and debentures lies in their nature and characteristics. Shares represent ownership in a company and provide shareholders with voting rights and the potential for capital appreciation. By contrast, debentures represent debt and entitle debenture holders to receive fixed interest payments and repayment of the principal amount. While shareholders are owners and participate in the company's profits and losses, debenture holders are creditors with a fixed claim on the company's assets.

Registration of Debentures: Debentures are typically registered with the company issuing them. Registration involves recording the details of the debentures, such as the names of the debenture holders, the principal amount, the interest rate, and the repayment terms. Registering debentures helps establish the legal rights and obligations of the debenture holders and provides a record for the company to manage interest payments, redemptions, and communication with debenture holders.

Different Classes of Shares: Companies may issue different classes of shares, such as ordinary shares, preference shares, or different classes of ordinary shares. Each class of shares may have distinct rights and characteristics. For example, preference shares may have preferential rights to receive dividends or to be repaid capital ahead of ordinary shareholders. Different classes of shares allow companies to tailor the rights and benefits associated with each class to meet specific objectives or accommodate different types of investors.

Rights of Different Classes: Different classes of shares may have distinct rights attached to them, which can vary from class to class. These rights are typically defined in the company's articles of association and may include voting rights, dividend entitlements, priority in asset distribution, and other special privileges. The rights of different classes of shares enable companies to structure their share capital in a way that accommodates varying interests and investment preferences.

The Variation of Share Rights: Companies may seek to vary the rights attached to a particular class of shares. Shareholders' approval and compliance with legal requirements are generally necessary to effect changes in share rights. This can be done through various mechanisms, such as passing a special resolution at a general meeting of the shareholders or obtaining court approval. Any variation of share rights must be done in accordance with the company's constitution and relevant legal provisions to ensure fairness and protection for shareholders.

Capital: Capital refers to the financial resources, including funds and assets, that a company possesses. It represents the total value of the company's assets minus its liabilities and reflects the company's financial strength and capacity to generate returns for shareholders.

Raising Capital: Companies raise capital to finance their operations, investments, and growth. They can raise capital through various means, such as issuing shares, debentures, or obtaining loans from financial institutions. Capital can also be raised through alternative methods like crowdfunding or venture capital investments. The purpose of raising capital is to provide the company with the necessary financial resources to meet its objectives and expand its operations.

Maintaining Capital: Companies are required to maintain a minimum level of capital to ensure solvency and protect the interests of creditors. Maintaining capital involves preserving the company's net assets above a specified threshold. The aim is to safeguard the company's ability to meet its financial obligations and protect stakeholders from undue risk. Failure to maintain capital may result in legal consequences, such as restrictions on dividend payments or potential insolvency proceedings.

Reducing Capital: Companies may sometimes decide to reduce their capital, which involves decreasing the nominal value of shares or returning capital to shareholders. Capital reduction can be undertaken for various reasons, such as eliminating accumulated losses, adjusting the capital structure, or returning excess capital to shareholders. The reduction of capital typically requires approval from shareholders and must comply with legal procedures and regulations.

Discounts: Discounts refer to a reduction in the price of securities or shares below their nominal or face value. Companies may offer discounts on newly issued shares or securities to incentivise investors to purchase them. Discounts can be used to attract investors, particularly during initial public offerings (IPOs) or rights issues. They effectively reduce the cost per share for investors, making the investment more appealing.

Premiums: Premiums are additional amounts charged above the nominal or face value of shares or securities. Companies may issue shares at a premium when there is strong demand or when the perceived value of the company exceeds its nominal value. Premiums represent the additional value investors are willing to pay for the shares or securities based on factors such as the company's performance, prospects, or market conditions.

Payment of Dividends: Dividends are distributions of profits made by companies to their shareholders. The payment of dividends is a way for companies to share their financial success with shareholders. Dividends are typically declared by the company's board of directors and approved by shareholders. The amount and timing of dividend payments depend on factors such as the company's financial performance, available profits, and dividend policy.

Purchase by the Company of Its Shares: Companies may buy back their own shares from shareholders, which is known as a share repurchase or buyback. This can be done for various reasons, such as returning surplus capital to shareholders, supporting the share price, or consolidating ownership. Share buybacks can be executed through open market purchases or through specific repurchase programs approved by shareholders.

Financial Assistance for the Purchase of Its Shares: Financial assistance refers to the provision of financial resources, such as loans or guarantees, by a company to facilitate the acquisition of its own shares. In many jurisdictions, providing financial assistance for the purchase of its own shares is restricted or prohibited to protect creditors' interests and ensure the company's financial stability.

Raising Capital from the Public: Companies may choose to raise capital by offering shares or other securities to the public through an IPO or a public offering. This involves issuing a prospectus or listing particulars that provide detailed information about the company, its financials, and the offering. Raising capital from the public requires compliance with regulatory requirements, including providing accurate and complete disclosure to potential investors.

Requirements for Prospectuses and Listing Particulars: Prospectuses and listing particulars are documents that provide detailed information about a company when it seeks to raise capital from the public or list its securities on a stock exchange. The requirements for prospectuses and listing particulars vary depending on the jurisdiction and the nature of the offering. However, common elements include disclosing information about the company's financials, operations, management, risks, and the purpose of the offering. The documents should be prepared in accordance with applicable securities laws and regulations to ensure that investors have access to accurate and complete information to make informed investment decisions.

Liquidation: Liquidation, also called winding-up, is the process of winding up a company's affairs, distributing its assets, and ultimately dissolving the company. It can occur voluntarily or involuntarily in situations where the company is unable to pay its debts or where it is no longer economically viable to continue its operations. There are two main types of liquidation:

Voluntary Liquidation: Voluntary liquidation occurs when the company's shareholders resolve to wind up the company's affairs. It can be either a members' voluntary liquidation (MVL) or a creditors' voluntary liquidation (CVL). In an MVL, the company is solvent, and its shareholders pass a resolution to wind up the company voluntarily. The appointed liquidator's primary duty is to distribute the company's assets to the shareholders. In a CVL, the company is insolvent, and its directors convene a meeting of shareholders to resolve to wind up the company. The appointed liquidator's duty is to realise the company's assets and distribute the proceeds to the creditors.

Compulsory Liquidation: Compulsory liquidation is a court-driven process initiated by a creditor, shareholder, or the company itself. It occurs when the court issues a winding-up order against the company due to its inability to pay its debts. In compulsory liquidation, a liquidator is appointed by the court to oversee the winding-up process and distribution of assets.

The Powers and Duties of the Liquidator: The liquidator in a company's winding-up process holds significant powers and duties. He has the authority to take custody and control of the company's assets, sell or dispose of those assets to realise their value, initiate or defend legal proceedings on behalf of the company, investigate the company's affairs for any misconduct, fraudulent activities, or improper transactions, pay the company's debts, and distribute the remaining assets to the stakeholders in accordance with the legal requirements and order of priority. The liquidator is responsible for conducting the liquidation process diligently, impartially, and in the best interests of the creditors and shareholders, while maintaining accurate records, preparing reports, and cooperating with relevant parties and authorities throughout the process.

Company Law covers a wide range of topics, including company formation, corporate governance, shareholder rights, directors' duties, capital raising, corporate finance, and corporate liability. It provides you with a comprehensive understanding of the legal principles and practical considerations necessary to navigate the complex world of corporate entities.

You can learn more about each topic and relevant case law with our exam-focused Company Law notes.