Equity and Trusts deals with the principles, rules, and doctrines related to fairness and the creation, administration, and enforcement of trusts. It is required for entry into bar training and heavily assessed in the SQE for intending solicitors. Therefore, although it is one of the most difficult modules, most LLB students choose to study it in Year 3. Here is a summary of all the topics covered in the module:

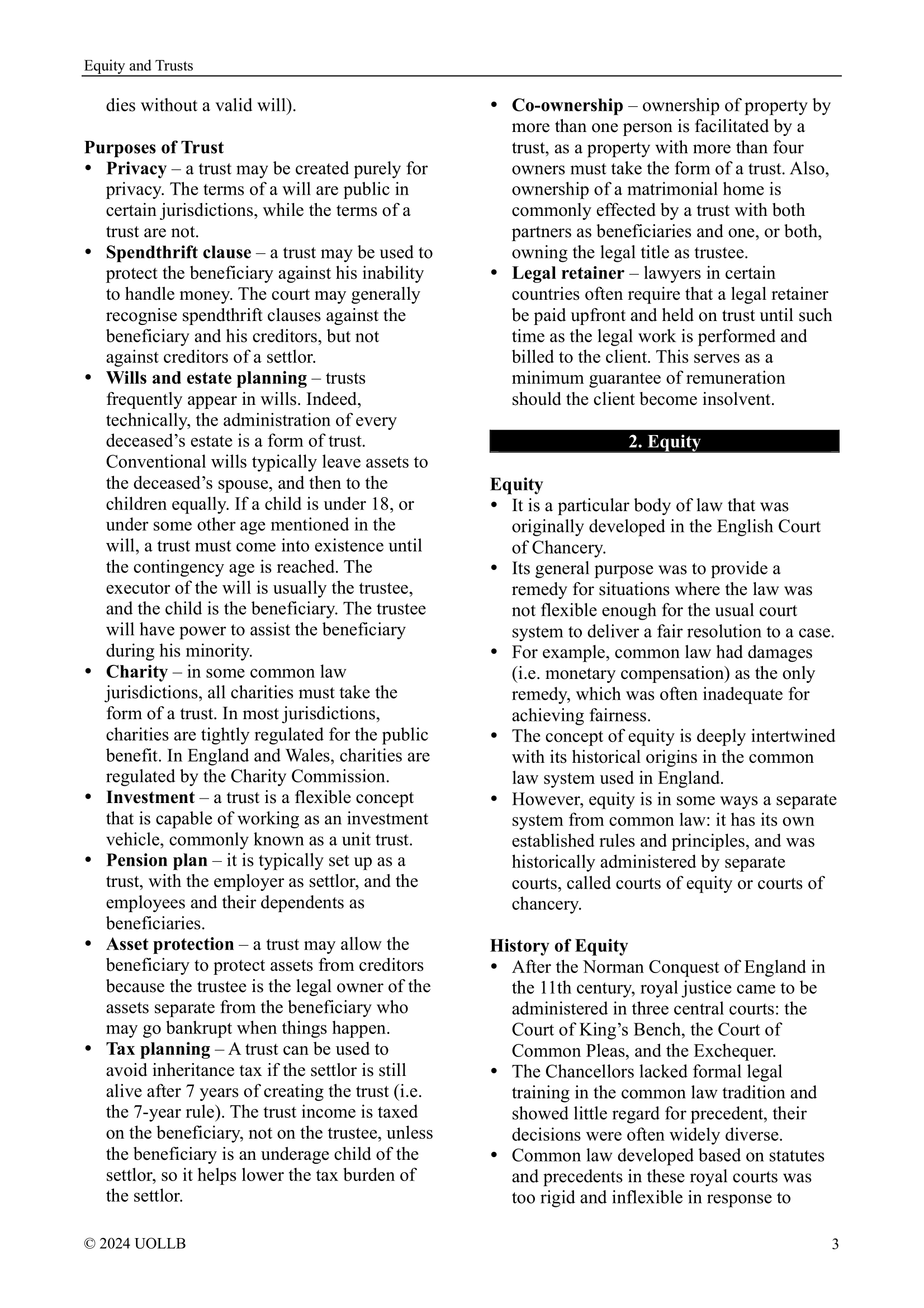

Trusts Law: Trusts law is a legal framework that governs the creation, administration, and dissolution of trusts. It encompasses a set of rules and principles that dictate how assets can be held and managed by one party (the trustee) for the benefit of another party (the beneficiary). Trusts law ensures the protection of beneficiaries' interests and ensures the trustee carries out their fiduciary duties faithfully.

Trust: A trust is a legal arrangement in which a person or entity (the settlor) transfers assets to another person or entity (the trustee) to hold and manage for the benefit of one or more individuals or organisations (the beneficiaries). The trustee has a legal obligation to administer the trust assets according to the terms and conditions specified in the trust deed or agreement.

Classification of Trusts: Trusts can be classified into various categories based on their purpose, nature, and formation. Common types include revocable trusts, irrevocable trusts, testamentary trusts, charitable trusts, discretionary trusts, and constructive trusts. Each classification has distinct characteristics and serves specific objectives, such as asset protection, estate planning, charitable giving, or providing for beneficiaries with special needs.

Equitable Rights: Equitable rights refer to the rights and interests recognised and enforced by equity, a branch of law that complements the legal system. It provides remedies when legal remedies are inadequate. Equitable rights ensure fairness, justice, and the recognition of certain rights that may not be explicitly addressed by common law principles. Examples of equitable rights include the right to specific performance, the right to fiduciary duties, and the right to a fair distribution of assets in a trust.

Equitable Remedies: Equitable remedies are the legal remedies granted by a court of equity, which may include injunctions, specific performance, rescission, rectification, and accounting. These remedies aim to address situations where monetary compensation alone is insufficient or inappropriate. Equitable remedies focus on achieving fairness, rectifying injustices, and enforcing obligations that go beyond monetary compensation.

Express Private Trusts: Express private trusts are trusts created intentionally by the settlor through a clear and unambiguous expression of their wishes. The terms and conditions of the trust are explicitly stated in a written document or agreement, such as a trust deed. Express private trusts allow the settlor to define the purpose of the trust, designate the beneficiaries, specify the assets included, and outline the powers and responsibilities of the trustee. These trusts are widely used for estate planning, asset protection, and managing family wealth.

Statutory Requirements for the Creation of Express Private Trusts: While the specific requirements may vary by jurisdiction, certain general elements must typically be met for the valid creation of an express private trust. These include the intention to create a trust, identification of the trust property, designation of beneficiaries, appointment of a trustee, and compliance with any formalities prescribed by law, such as written documentation or witnessing. Adhering to these statutory requirements ensures the trust's validity and enforceability.

Secret Trusts: Secret trusts arise when a testator makes a provision in his will for property to be held on trust, but the existence or terms of the trust are not expressly stated in the will. Instead, the testator communicates his wishes to the intended trustee either orally or in writing outside the will. Secret trusts are typically used when the testator wishes to maintain confidentiality regarding the trust's details, such as the beneficiaries or specific instructions. These trusts are enforceable in certain jurisdictions, provided the requirements for their creation are fulfilled.

Incompletely Constituted Trusts: An incompletely constituted trust refers to a trust that has not been fully established due to the absence of certain essential elements. For example, if a settlor transfers property to a trustee but fails to specify the beneficiaries or the trust's terms, the trust may be deemed incomplete. In such cases, the court may refuse to recognise the trust until the missing elements are properly addressed and fulfilled. Incompletely constituted trusts may also arise when the settlor fails to transfer legal ownership of the assets to the trustee.

Certainties of a Trust: Certainties are fundamental principles that must be present for a trust to be valid. These certainties include certainty of intention (the settlor's clear intention to create a trust), certainty of subject matter (the trust property must be identifiable), and certainty of objects (the beneficiaries must be clearly identified or capable of being ascertained). These certainties ensure that the trust's purpose and beneficiaries are sufficiently defined, allowing for the trust's proper administration and enforcement.

Protective Trusts: Protective trusts, also known as spendthrift trusts, are designed to protect the beneficiaries' interests from their own mismanagement or potential creditors. The trustee has discretionary control over the distribution of trust assets, safeguarding them for the beneficiaries' long-term welfare. Creditors generally cannot seize the trust assets to satisfy the beneficiaries' debts. Protective trusts are commonly used to provide ongoing financial support for individuals with spendthrift tendencies, beneficiaries with special needs, or those facing potential financial risks.

Discretionary Trusts: In a discretionary trust, the trustee has the discretion to determine how and when to distribute trust assets among a class of beneficiaries. The settlor may provide guidelines or a letter of wishes, but the trustee has the final authority to exercise his discretion. This flexibility allows the trustee to consider the beneficiaries' changing circumstances and needs, ensuring the assets are distributed in the most beneficial manner. Discretionary trusts provide asset protection, tax planning opportunities, and the ability to address complex family dynamics.

Purpose Trusts: Purpose trusts are trusts established for a specific non-charitable purpose rather than for the benefit of individual beneficiaries. The purpose must be clear, specific, and lawful. Examples include trusts for the advancement of education, promotion of religious activities, or maintenance of historic buildings. Unlike private trusts, purpose trusts do not have identifiable beneficiaries or an obligation to distribute income or assets to individuals. The enforceability of purpose trusts varies across jurisdictions, with some jurisdictions limiting their validity to certain recognised purposes.

Powers of Trustees: Trustees possess various powers granted to them either explicitly by the trust instrument or implied by law. These powers enable trustees to manage and administer the trust effectively. Common powers include the power to invest trust funds, make distributions to beneficiaries, enter into contracts, lease or sell trust property, pay expenses and taxes, and engage professional advisors. However, trustees must exercise their powers in accordance with their fiduciary duties and the terms of the trust.

Duties of Trustees: Trustees have fiduciary duties that require them to act in the best interests of the beneficiaries and the trust. These duties include the duty of loyalty (acting solely in the beneficiaries' interests), the duty of care (exercising reasonable care, skill, and prudence), the duty to act in accordance with the trust instrument, the duty to keep accurate records, and the duty to avoid conflicts of interest. Trustees must act honestly, impartially, and diligently while managing the trust assets and carrying out their responsibilities.

Investment of Trust Funds: Trustees have a duty to prudently invest trust funds to maximise returns while considering the beneficiaries' needs and the preservation of capital. The investment decisions should align with the trust instrument, any applicable laws or regulations, and the trustee's duty of care. Trustees must diversify investments, consider risk tolerance, and seek professional advice when needed. The specific investment powers and restrictions may be outlined in the trust instrument or governed by applicable trust laws.

Maintenance and Advancement: Trustees may have the power to make maintenance and advancement payments from the trust income or capital for the benefit of beneficiaries. Maintenance refers to providing for the beneficiaries' day-to-day living expenses, while advancement allows trustees to provide larger sums for specific purposes, such as education, healthcare, or purchasing a home. Trustees must exercise these powers in accordance with the terms of the trust and the best interests of the beneficiaries.

Accumulation of Income: Some trusts may include provisions allowing trustees to accumulate income instead of distributing it to beneficiaries. This power enables trustees to retain income within the trust, allowing it to grow over time. Accumulation may be desirable for various reasons, such as protecting assets, funding future obligations, or providing for beneficiaries at a later stage in their lives. The power to accumulate income is subject to any limitations or directions specified in the trust instrument or applicable laws.

Delegation of Trustees' Powers: In certain circumstances, trustees may delegate some of their powers to agents or professionals to assist with trust administration. However, trustees are ultimately responsible for overseeing the actions of those to whom they delegate powers. Trustees must exercise caution when delegating and ensure that the individuals or entities they delegate to have the necessary qualifications, competence, and integrity to fulfil their delegated responsibilities.

Discretions of Trustees: Trust documents often grant trustees discretionary powers, allowing them to exercise judgment and make decisions without being bound by strict instructions. These discretions may include the discretion to distribute income or principal, determine beneficiaries' entitlements, invest trust funds, or interpret ambiguous provisions. While exercising discretion, trustees must act honestly, in good faith, and consider relevant factors. Courts generally respect the exercise of discretionary powers by trustees unless they are found to be irrational, arbitrary, or in breach of fiduciary duties.

Charitable Trusts: Charitable trusts are trusts established for charitable purposes, primarily benefiting the public or a section of society. They are created with the intention of promoting causes such as education, poverty relief, advancement of religion, promotion of health, or any other charitable endeavour. Charitable trusts play a vital role in supporting philanthropic activities and addressing societal needs.

Distinctions of Charitable Trusts from Private Trusts: Charitable trusts differ from private trusts in several key aspects. While private trusts primarily benefit specific individuals or families, charitable trusts benefit the public or a charitable purpose. Private trusts focus on the private interests of beneficiaries, whereas charitable trusts focus on advancing the broader public good. Additionally, charitable trusts often enjoy certain tax advantages and may be subject to specific legal requirements and regulations due to their charitable nature.

Classification of Charitable Trusts: Charitable trusts can be classified into various categories based on their nature and purpose. Common classifications include trusts for the relief of poverty, advancement of education, advancement of religion, promotion of health, support of arts and culture, and protection of the environment. Each classification serves a distinct charitable objective, and specific legal requirements and regulations may apply to each type.

Doctrine of Cy Près: The doctrine of cy près, derived from the French term meaning "as near as possible," is a legal principle that allows a court to modify the terms of a charitable trust when the original charitable purpose becomes impracticable, impossible, or illegal to fulfil. Under this doctrine, the court may alter the terms of the trust to ensure that the trust's assets are used for a purpose as close as possible to the original charitable intent. The court's decision is based on the intention of the settlor and the best interests of the charitable objectives. The doctrine of cy près enables charitable trusts to adapt and continue serving charitable purposes even when circumstances change.

Resulting Trusts: Resulting trusts are trusts that arise by operation of law when property is transferred or held under circumstances that suggest an intention for the transferor to retain beneficial ownership or for someone other than the transferee to hold the property on his behalf. Resulting trusts typically occur when the legal owner of the property holds it in trust for another person who does not have legal title. They can arise in various situations, such as when a trust fails, when there is a lack of evidence of a specific intention, or when a voluntary conveyance occurs without consideration.

Voluntary Conveyances: Voluntary conveyances refer to the transfer of property without the exchange of valuable consideration. In such cases, the transferor willingly transfers property to another person without receiving anything in return. Voluntary conveyances can give rise to resulting trusts if the circumstances surrounding the transfer suggest an intention for the transferee to hold the property on behalf of the transferor or for the benefit of a third party.

Purchase in the Name of Another: A purchase in the name of another occurs when someone acquires property but holds legal title in the name of another person. This situation may give rise to a resulting trust if there is evidence to suggest that the person acquiring the property did not intend for the legal owner to be the beneficial owner. In such cases, a resulting trust may be presumed, and the legal owner is considered to hold the property in trust for the true beneficial owner.

Failed Trusts: Failed trusts are trusts that are invalid or unenforceable due to various reasons, such as lack of certainty, illegality, or the inability to meet legal requirements. When a trust fails, resulting trusts can arise to determine the disposition of the trust property. Resulting trusts may be implied by law to prevent unjust enrichment or to ensure that the property reverts to the original owner or his estate.

Presumption of Resulting Trusts: The presumption of resulting trusts is a legal presumption that arises when there is no evidence of a specific intention regarding the beneficial ownership of property. In such cases, the law presumes that the person holding legal title holds it on resulting trust for the person who provided the purchase money or contributed to the acquisition of the property. The presumption of resulting trusts can be rebutted by providing evidence of a different intention or agreement.

Presumption of Advancement: The presumption of advancement is the opposite of the presumption of resulting trusts. It applies when a person, usually a parent or spouse, transfers property to another person, typically a child or spouse, without any consideration. The presumption of advancement assumes that the transfer is intended as a gift and that the recipient holds beneficial ownership. This presumption can be relevant in family law and property matters, but it can be rebutted by evidence showing a different intention.

Reasons Resulting Trusts Arise: Resulting trusts can arise for various reasons. Some common reasons include when there is a lack of evidence regarding the intention of the parties involved, when a trust fails, when a voluntary conveyance occurs without consideration, or when property is purchased in the name of another. Resulting trusts provide a legal mechanism to prevent unjust enrichment and ensure that property is held and distributed in accordance with the intentions and contributions of the parties involved.

Constructive Trusts: Constructive trusts are a type of trust that is imposed by a court of law, regardless of the parties' actual intentions, to prevent unjust enrichment or to remedy a wrongful act. Constructive trusts are not created by the explicit agreement or intention of the parties involved but rather by operation of law.

General Nature of Constructive Trusts: Constructive trusts are characterised by the court's imposition of a fiduciary relationship on the legal owner of property, requiring them to hold the property for the benefit of another party. The purpose of a constructive trust is to ensure fairness and equity in situations where the legal owner would be unjustly enriched or has obtained the property through wrongful or unjust means.

Constructive Trusts of Wrongful Enrichment: Constructive trusts of wrongful enrichment arise when a person acquires property through fraud, misrepresentation, or some other wrongful act. In such cases, a court may impose a constructive trust to prevent the unjust enrichment of the wrongdoer and to restore the property to its rightful owner.

Constructive Trusts of Unjust Enrichment: Constructive trusts of unjust enrichment occur when a person is unjustly enriched at the expense of another. For example, if someone receives property or benefits without a legal basis or justification, a court may impose a constructive trust to ensure that the unjustly enriched party holds the property in trust for the person who should rightfully benefit.

Constructive Trusts Arising for Other Reasons: Constructive trusts can also arise in situations beyond wrongful or unjust enrichment. They can be imposed for various reasons, such as to fulfil the parties' common intention or to prevent a party from taking unfair advantage of his position or the trust and confidence placed in them. The specific circumstances in which a constructive trust may be imposed can vary depending on the jurisdiction and applicable laws.

The Contractual Vendor as a Constructive Trustee: In certain situations, when a vendor has received payment for property but fails to complete the transfer of legal title, he may be deemed a constructive trustee. This means he is obligated to hold the property in trust for the purchaser until the transfer is completed. The constructive trust arises to prevent the vendor from unjustly benefiting from the purchaser's payment while failing to fulfil his contractual obligations.

Comparison with Proprietary Estoppel: Constructive trusts and proprietary estoppel are legal concepts that are similar in nature but have distinct differences. While both can result in the imposition of equitable remedies, constructive trusts typically involve the transfer or retention of property, while proprietary estoppel focuses on the assurance or expectation of an interest in property. Proprietary estoppel arises when someone relies on another's assurance or representation regarding the ownership or use of property and suffers detriment as a result. In contrast, constructive trusts are imposed to prevent unjust enrichment or address wrongful acts related to property ownership or acquisition.

Appointment of Trustees: The appointment of trustees refers to the process of selecting individuals or entities to assume the role of trustees and manage the affairs of a trust. The appointment can be made through various means, such as by the settlor (the person who creates the trust) in the trust instrument, by a court of law, or through a power of appointment granted to a third party. The appointment of trustees should consider their suitability, competence, and ability to fulfil their fiduciary duties.

Retirement of Trustees: Trustees may retire from their position voluntarily or in accordance with the terms specified in the trust instrument. Retirement typically requires following the procedures outlined in the trust instrument or obtaining the consent of all parties involved, such as beneficiaries or co-trustees. The retirement process may involve the appointment of new trustees to ensure the ongoing administration of the trust.

Removal of Trustees: Trustees can be removed from their position under certain circumstances, such as misconduct, breach of trust, incapacity, or conflict of interest. The removal may be initiated by beneficiaries, co-trustees, or through a court application. The court has the authority to remove a trustee if it deems it necessary for the proper administration of the trust or to protect the interests of the beneficiaries.

Variation of Trusts: Variation of trusts refers to the process of making changes to the terms, provisions, or administration of a trust. Trust variations can be necessary when circumstances change, beneficiaries' needs evolve, or to address unforeseen situations. The variation of trusts can be achieved through various methods, such as by obtaining the consent of all interested parties, applying to the court for approval, or using statutory provisions or trust powers specifically granted in the trust instrument.

Remedies for Breach of Trust: When a trustee breaches their fiduciary duties or fails to fulfil their obligations, various remedies may be available to address the breach and protect the interests of the beneficiaries. Remedies can include monetary damages, restoration of trust property, removal of the trustee, appointment of new trustees, injunctions, and other equitable relief. The specific remedies depend on the jurisdiction, applicable laws, and the nature and extent of the breach. Beneficiaries or interested parties can seek these remedies through court proceedings or by negotiating with the trustees to rectify the breach.

Trustees' Liability to Account: Trustees have a fiduciary duty to account for their actions and manage the trust assets diligently. They are responsible for keeping accurate records, providing regular accountings to beneficiaries, and disclosing information about the trust's financial transactions and investments. Trustees can be held liable if they fail to fulfil their duty to account, including if they fail to provide accurate and timely information or if they engage in improper or negligent handling of the trust's finances.

Equitable Compensation: Equitable compensation refers to the right of trustees to be reimbursed for their reasonable expenses and to receive fair remuneration for their services in managing the trust. Trustees are generally entitled to receive compensation unless the trust instrument explicitly waives or limits such compensation. The amount of equitable compensation can vary and is typically based on factors such as the complexity of the trust, the time and effort expended by the trustee, and prevailing industry standards.

Exemption Clauses: Exemption clauses are provisions included in trust instruments that seek to limit or exclude trustees' liability for certain acts or omissions. These clauses may attempt to protect trustees from personal liability for breaches of trust, negligence, or other forms of misconduct. However, the enforceability of exemption clauses can vary depending on the jurisdiction and the specific circumstances involved. In some cases, courts may refuse to enforce exemption clauses if they are deemed to be unreasonable, contrary to public policy, or if they conflict with mandatory legal obligations.

Trustees' Right of Indemnity: Trustees have a right of indemnity, which means they are entitled to be reimbursed from the trust assets for expenses, losses, and liabilities incurred in the proper administration of the trust. The right of indemnity allows trustees to be reimbursed for costs associated with defending legal actions, fulfilling their duties, and administering the trust. The right of indemnity is generally available unless the trustee has acted in breach of trust or with negligence.

Trustees' Right of Contribution: In cases where there are multiple trustees involved in the administration of a trust, the right of contribution allows a trustee who has paid more than his share of liabilities or expenses to seek reimbursement from the other trustees. This right ensures that the burden of costs and liabilities is shared fairly among the trustees. The right of contribution can be enforced through legal action or negotiation among the trustees to apportion expenses and liabilities appropriately.

Dishonest Assistance: Dishonest assistance is a legal concept that holds individuals accountable for assisting in a breach of trust or fiduciary duty. It applies to third parties who knowingly and dishonestly assist a trustee or fiduciary in misappropriating or misusing trust assets. By providing assistance, such as advice, support, or participation, the third party becomes liable for any loss suffered by the trust or beneficiaries as a result of the breach.

Knowing Receipt: Knowing receipt is a legal principle that applies when a person receives trust property or assets with knowledge that the transfer was a breach of trust. If a person receives trust property in such circumstances and benefits from it, he may be held accountable for the value of the property or assets received. The principle of knowing receipt allows the trust or beneficiaries to trace and recover the misappropriated assets from the recipient.

Claims Based on Tracing: Tracing is a legal process that allows the recovery of misappropriated or misused trust property or assets. When trust assets are wrongfully transferred or commingled with other assets, tracing enables the identification and recovery of the original trust property or its proceeds. The process involves establishing a causal connection between the misappropriated assets and the assets currently held by the recipient.

Tracing Rules: Tracing rules are legal principles and techniques used to track and identify misappropriated assets and establish a claim to their recovery. The rules vary depending on the jurisdiction, but common tracing methods include following the money trail, establishing a trust's equitable interest in substituted assets, and using equitable remedies like proprietary claims. Tracing can be a complex process, requiring evidence and legal arguments to establish the link between the misappropriated assets and the assets held by the recipient.

Liens: Liens are legal rights or interests held over property as security for a debt or obligation. In the context of trusts, a lien may be created when a trustee incurs a debt or obligation on behalf of the trust. The lien gives the creditor a right to claim and, if necessary, sell the trust property to satisfy the debt. Liens can provide a mechanism for enforcing payment or securing the interests of creditors against trust assets.

Subrogation: Subrogation is a legal principle that allows a party who has discharged a debt or obligation on behalf of another to step into the shoes of the original creditor and assert his rights. In the context of trusts, subrogation can arise when a third party pays off a debt or liability owed by the trust. By subrogation, the party that made the payment assumes the rights and remedies of the original creditor and can seek reimbursement or enforce the claim against the trust assets.

Equity and Trusts provides you with a comprehensive understanding of essential concepts all lawyers must know, including the principles and rules governing trusts and equity. This module equips you with the knowledge to navigate the legal complexities involved in creating, administering, and enforcing trusts and seeking equitable remedies.

You can learn more about each topic and relevant case law with our exam-focused Equity and Trusts notes.