Commercial Law governs the rights, relations, and conduct of individuals and entities engaged in commercial activities. You can select this module in Year 2. Although it is not assessed in SQE, nor is it required for entry into bar training, many intending lawyers choose to study this module because commercial lawyers are in high demand. Here is a summary of the topics covered in this module:

Personal Property: Personal property refers to movable assets or belongings that are owned by individuals or legal entities. It includes items such as money, vehicles, furniture, jewellery, clothing, electronics, and other tangible objects that are not considered real estate or immovable property. Personal property can be bought, sold, transferred, or inherited.

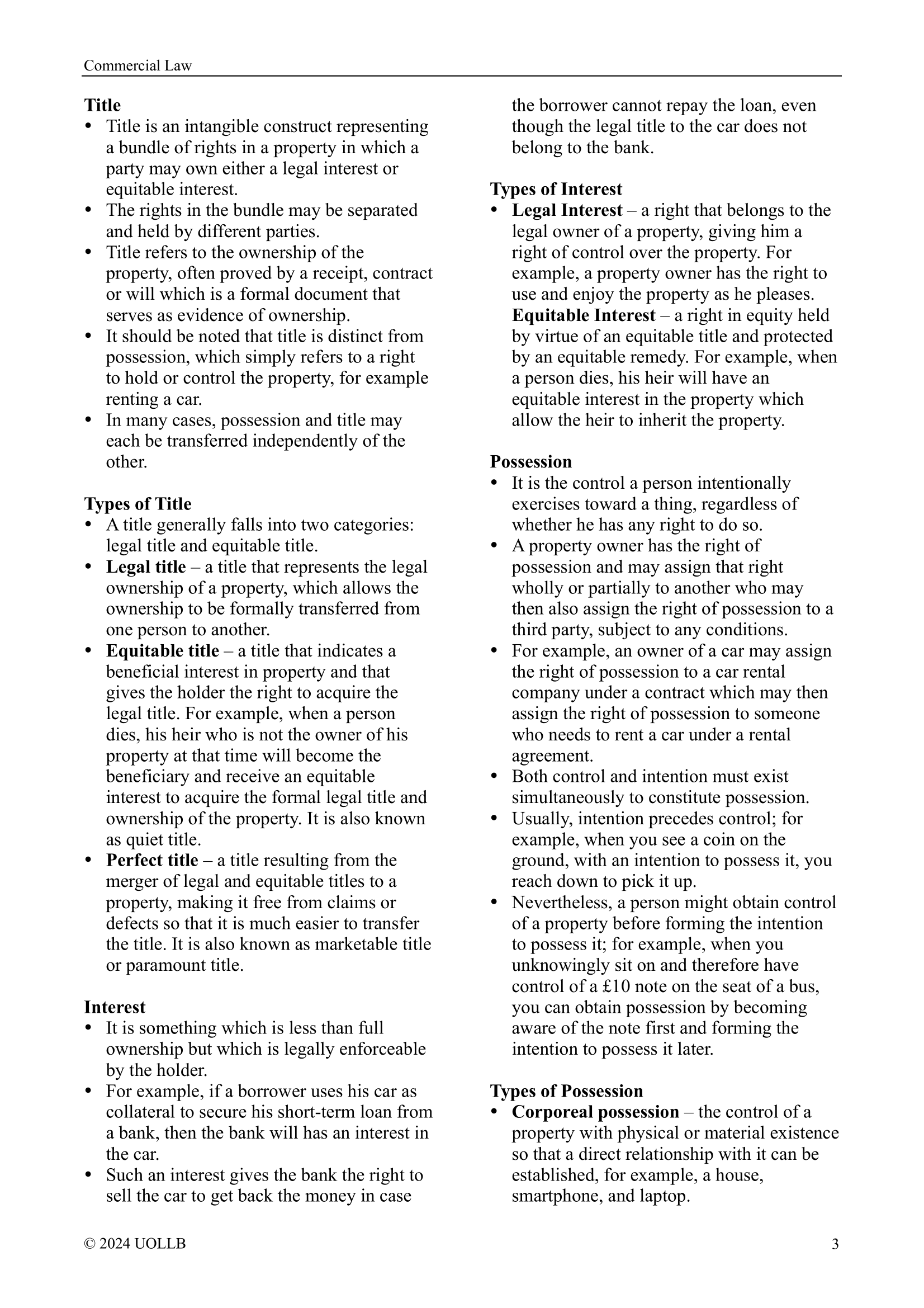

Defining the Concepts of Property: In legal terms, property refers to the legal right or ownership of assets or resources. It encompasses both real property (land and buildings) and personal property (movable possessions). Property rights include the right to possess, use, enjoy, transfer, and exclude others from the property. Property rights are typically protected by law and can be enforced through legal mechanisms.

Definition of Ownership: Ownership refers to the legal right to possess, control, and use property. It entails the exclusive rights to enjoy the benefits, income, and use of the property, as well as the authority to transfer, sell, or dispose of the property. Ownership can be held by individuals, businesses, or other legal entities, and it is typically established through legal means such as purchase, inheritance, or gift.

Definition of Possession: Possession refers to having physical control or custody over property. It is the actual holding, occupancy, or control of an object or asset. Possession may or may not coincide with ownership. For example, a person may possess an item without actually owning it, such as when borrowing or renting an item. Possession can be a factor in determining certain legal rights and responsibilities, but it does not always equate to ownership.

Types and Nature of Personal Property: Personal property can be categorised into tangible and intangible property. Tangible personal property includes physical objects that can be touched, seen, and moved, such as vehicles, furniture, and clothing. Intangible personal property refers to assets that do not have a physical form but represent certain rights or interests, such as bank accounts, stocks, patents, trademarks, and intellectual property.

Interests in Personal Property: Interests in personal property refer to the various rights and claims that individuals or entities can have over personal property. These interests can include ownership, possession, security interests (such as mortgages or liens), leases, licenses, and other contractual or legal rights. Interests in personal property can be transferred, shared, or encumbered through legal agreements or arrangements.

Different Contracts for the Transfer of Interests in Personal Property: There are various types of contracts used for the transfer of interests in personal property. Some common examples include:

- Sale/Purchase agreement: A contract where one party agrees to transfer ownership of personal property to another party in exchange for consideration (usually money).

- Lease/Rental agreement: A contract that allows one party (the lessee) to possess and use personal property owned by another party (the lessor) for a specified period of time in exchange for payment.

- Loan agreement: A contract where one party lends personal property to another party, typically with the expectation of its return, along with any agreed-upon interest or fees.

- Licensing agreement: A contract where the owner of certain intellectual property grants another party the right to use, manufacture, or distribute the intellectual property in exchange for compensation.

- Bailment agreement: A contract where one party (the bailor) temporarily transfers possession of personal property to another party (the bailee) for a specific purpose, with the expectation of the property's return.

Sale of Goods: The sale of goods refers to the transfer of ownership of tangible, movable items from a seller to a buyer in exchange for a price. The Sale of Goods Act 1979 (in the United Kingdom) and similar laws in other jurisdictions govern the rights and obligations of parties involved in the sale of goods, including the seller's duty to provide goods of satisfactory quality and the buyer's duty to pay the agreed price.

Differences between Commercial and Consumer Sales: Commercial sales involve transactions where both the seller and the buyer are engaged in business or commercial activities. The sale of goods in a commercial context is typically governed by commercial laws, and the parties are presumed to have equal bargaining power and expertise. Consumer sales, on the other hand, involve transactions where the buyer is an individual purchasing goods for personal use, rather than for business purposes. Consumer sales are subject to consumer protection laws and regulations that aim to protect consumers' rights and ensure fair and transparent transactions.

Approach to the Interpretation of the Sale of Goods Act 1979: The interpretation of the Sale of Goods Act 1979 (or similar legislation) follows general principles of statutory interpretation. Courts interpret the Act by examining the text of the law, considering its purpose and objectives, and referring to any relevant case law or legal principles. The aim is to give effect to the legislative intent and provide a consistent and fair interpretation of the provisions within the Act.

Components of a Contract of Sale: A contract of sale consists of several essential components, including:

- Offer and acceptance: The seller makes an offer to sell the goods, and the buyer accepts the offer, creating a binding agreement between the parties.

- Consideration: The buyer agrees to pay a price or provide something of value in exchange for the goods.

- Intention to transfer ownership: Both parties intend to transfer ownership of the goods from the seller to the buyer.

- Goods: The subject matter of the contract is tangible, movable items that are capable of being bought and sold.

- Legal capacity: The parties involved must have the legal capacity to enter into a contract, such as being of legal age and mentally competent.

Circumstances in which Property in Goods is Passed: The passing of property in goods refers to the point at which ownership or title to the goods transfers from the seller to the buyer. The Sale of Goods Act 1979 provides specific rules to determine when property in goods passes, which can vary depending on the terms of the contract and the intention of the parties. Some common circumstances include:

- Specific goods: Property passes when the parties intend it to pass, usually at the time of the contract or when the seller transfers possession of the goods to the buyer.

- Unascertained goods: Property passes when the goods are ascertained and identified, and the buyer is notified of the specific goods to be delivered.

- Goods in transit: Property passes when certain conditions are met, such as when the goods are delivered to the carrier for transportation or when the buyer takes possession of the goods.

How Risk is Passed: The passing of risk in the sale of goods refers to when the responsibility for any loss, damage, or destruction of the goods transfers from the seller to the buyer. The rules for passing risk can vary depending on the terms of the contract and the intention of the parties. Generally, risk passes when property in the goods passes. However, the parties can agree to different terms regarding the transfer of risk, such as when the goods are delivered to a specific location or when certain events occur.

Nemo Dat Rule: The nemo dat rule is a fundamental principle in the law of sale of goods, which means "no one can give what they do not have." According to this rule, a person cannot transfer a better title to a buyer than what he himselves possess. In other words, if someone sells goods he does not own or have the authority to sell, the buyer does not acquire good title to the goods.

Exceptions to the Nemo Dat Rule: While the nemo dat rule is a general principle, there are certain exceptions where a person who is not the owner can still transfer valid title to a buyer. Some common exceptions include:

- Sale by a mercantile agent: If a mercantile agent, who is in possession of goods with the owner's consent, sells the goods to a buyer in the ordinary course of business, the buyer may acquire a good title to the goods, even if the agent does not have the owner's authority.

- Sale under a Voidable Title: If the seller has obtained the goods by fraud, mistake, or other wrongful means, he may still transfer valid title to a buyer who purchases the goods in good faith and without notice of the seller's defect in title (i.e. bona fide purchaser for value without notice).

- Sale by estoppel: If the owner of the goods, by his conduct or representation, leads a third party to believe that another person has the authority to sell the goods, and the third party relies on this belief to his detriment by purchasing the goods, the third party may acquire a good title to the goods.

Duties of the Seller to Deliver Goods: Under the Sale of Goods Act 1979, the seller has certain duties to deliver the goods to the buyer. These duties include:

- Duty to deliver in accordance with the contract: The seller must deliver the goods in accordance with the terms and conditions specified in the contract of sale.

- Duty to deliver within a reasonable time: Unless otherwise agreed, the seller must deliver the goods within a reasonable time after the contract is made.

- Duty to deliver goods of satisfactory quality: The goods must be of satisfactory quality, fit for the intended purpose, and correspond with their description or any sample provided.

- Duty to deliver goods free from encumbrances: The seller must ensure that the goods are free from any third-party claims, liens, or encumbrances, unless otherwise agreed.

Duties of the Buyer to Accept Goods: The buyer has certain duties to accept the goods as per the terms of the contract. These duties include:

- Duty to accept delivery: The buyer must be ready and willing to accept delivery of the goods in accordance with the contract.

- Duty to pay the price: The buyer must pay the agreed price for the goods within the specified time or as per the terms of the contract.

- Duty to inspect the goods: The buyer has a duty to inspect the goods upon delivery and notify the seller of any defects or non-conformities within a reasonable time.

- Duty to mitigate loss: If the buyer refuses to accept the goods without valid reason, he has a duty to take reasonable steps to mitigate the seller's loss, such as by reselling the goods.

Implied Terms in Sections 12–15 of the Sale of Goods Act 1979: Sections 12 to 15 of the Sale of Goods Act 1979 contain important implied terms in a contract of sale. These terms include:

- Section 12 Implied Term as to Title: The seller must have the right to sell the goods, and the buyer will acquire good title to the goods, free from any undisclosed encumbrances.

- Section 13 Implied Term as to Description: Where the goods are sold by description, there is an implied term that the goods will correspond with the description given.

- Section 14 Implied Terms as to Quality or Fitness for Purpose: There are implied terms that the goods will be of satisfactory quality and fit for the intended purpose. This means that the goods should be of a standard that a reasonable person would consider acceptable and should be suitable for the purpose for which they are intended.

- Section 15 Implied Terms as to Sample: If the goods are sold by reference to a sample, there is an implied term that the bulk of the goods will correspond with the sample in quality and condition.

Relationship between the Different Implied Terms: The implied terms in a contract of sale, such as those found in Sections 12–15 of the Sale of Goods Act 1979, work together to protect the rights of both buyers and sellers. These terms operate alongside any express terms agreed upon by the parties. The relationship between the different implied terms can vary depending on the circumstances and the specific terms of the contract. However, generally:

- Title: The implied term as to title (Section12) ensures that the seller has the right to sell the goods and that the buyer will acquire good title, free from any undisclosed encumbrances.

- Description: The implied term as to description (Section13) ensures that the goods will correspond with the description provided by the seller.

- Quality: The implied terms as to quality or fitness for purpose (Section14) ensure that the goods will be of satisfactory quality, fit for the intended purpose, and meet any specific requirements agreed upon by the parties.

- Sample: The implied term as to sample (Section15) applies when the goods are sold by reference to a sample, ensuring that the bulk of the goods will correspond with the sample in quality and condition.

Limits of Exclusion or Restriction of Liability for Breach of Implied Terms: While parties to a contract of sale have the freedom to negotiate and agree upon the terms, including any exclusions or restrictions of liability, there are limits to such exclusions or restrictions, particularly for breach of implied terms. The Sale of Goods Act 1979 provides certain limitations on the extent to which liability for breach of these implied terms can be excluded or restricted. For example:

- Exclusion of liability for death or personal injury: Liability for death or personal injury resulting from negligence cannot be excluded or restricted.

- Reasonableness test: Any attempt to exclude or restrict liability for breach of implied terms must be reasonable. The reasonableness of such exclusion or restriction is determined based on the circumstances at the time the contract is made, including the bargaining power of the parties, the availability of alternatives, and the nature of the goods.

- Unfair contract terms: Exclusion or restriction of liability that is found to be unfair under the Unfair Contract Terms Act 1977 may be considered invalid or unenforceable.

Rules on Acceptance: Acceptance can be express or implied, and the specific rules and requirements may be governed by the terms of the contract, statutory provisions, or common law principles. The rules on acceptance determine when the risk of loss or damage to the goods passes to the buyer. In general, acceptance of goods occurs when the buyer indicates to the seller that he has accepted the goods, either expressly or by conduct, performs an act that is inconsistent with the seller's ownership, such as treating the goods as his own, or fails to reject the goods within a reasonable time after delivery or fails to communicate any defects or non-conformities to the seller.

Breach of the Sale Contract: Breach of the sale contract occurs when one party fails to perform its obligations under the contract. In the context of a sale of goods, it may involve the seller's failure to deliver the goods as specified in the contract, the seller's delivery of goods that do not conform to the agreed specifications or the implied terms, or the buyer's failure to accept or pay for the goods as agreed. When a breach of contract occurs, the innocent party may have various remedies available to them.

Remedies for the Buyer: The specific remedy available to the buyer will depend on the nature and severity of the breach, as well as the applicable laws and the terms of the contract. In general, when the seller breaches the sale contract, the buyer may be entitled to the following remedies:

- Damages: The buyer can claim monetary compensation to cover any losses suffered as a result of the breach, including the difference in value between the goods received and the goods as specified in the contract.

- Specific performance: In certain circumstances, the buyer may seek a court order requiring the seller to fulfil his obligations under the contract, such as delivering the agreed-upon goods.

- Rejection and refund: If the goods delivered do not conform to the contract or the implied terms, the buyer can reject the goods and seek a refund of the purchase price.

- Right to withhold payment: The buyer may have the right to withhold payment or make a partial payment until the seller remedies the breach.

- Right to rescind the contract: In serious cases of breach, the buyer may choose to terminate the contract altogether and seek a refund of any payments made.

Remedies for the Seller: When the buyer breaches the sale contract, the seller may have the following remedies:

- Damages: The seller can claim monetary compensation for any losses suffered as a result of the buyer's breach, such as loss of profit.

- Specific performance: In certain circumstances, the seller may seek a court order requiring the buyer to fulfil his obligations under the contract, such as accepting and paying for the goods.

- Withhold delivery: If the buyer fails to fulfil his obligations, the seller may have the right to withhold delivery of the goods until the breach is rectified.

- Resale of goods: If the buyer refuses to accept the goods or breaches the contract, the seller may resell the goods to mitigate his losses and claim any shortfall in price from the defaulting buyer.

Use of Retention of Title Clauses: Retention of title clauses, also known as Romalpa clauses, are provisions commonly included in sale contracts to protect the seller's ownership rights over the goods until certain conditions are met, typically full payment by the buyer. These clauses allow the seller to retain legal ownership of the goods until payment is made, even if the goods are in the possession of the buyer.

Limits of Retention of Title Clauses: While retention of title clauses can be useful for sellers to protect his interests, their effectiveness and enforceability can be subject to certain limitations, such as:

- Validity and enforceability: The clauses must be valid and enforceable under the applicable laws. Some jurisdictions may have specific requirements for these clauses to be legally binding.

- Third-party rights: If the buyer resells the goods to a third party who is unaware of the retention of title clause, the third party may acquire good title to the goods, overriding the seller's claim.

- Mixed goods: If the buyer combines the goods subject to the retention of title clause with other goods or transforms them into a new product, it can be challenging to identify and separate the original goods, affecting the enforceability of the clause.

- Timing and registration: The effectiveness of a retention of title clause may depend on the timing of its creation and registration, particularly in situations where the buyer becomes insolvent or goes into administration.

Distinct Approach Taken by the Consumer Rights Act 2015: The Consumer Rights Act 2015 introduced certain changes and provisions specific to consumer sales. It places more emphasis on consumer protection and includes provisions that strengthen consumer rights and remedies. Some key aspects of the Consumer Rights Act 2015 in relation to sales of goods include:

- Goods must be of satisfactory quality: The Act provides a statutory definition of satisfactory quality, stating that goods must meet a standard that a reasonable person would consider satisfactory, taking into account factors such as appearance, durability, safety, and fitness for purpose.

- Extended remedies: The Act introduces additional remedies for consumers, such as the right to repair or replacement, the right to a price reduction, and the right to reject faulty goods and obtain a refund.

- Short-term right to reject: The Act grants consumers a short-term right to reject goods that do not conform to the contract within 30 days of purchase, allowing for a full refund.

Residual Importance of the Sale of Goods Act 1979: Although the Consumer Rights Act 2015 introduced changes specific to consumer sales, the Sale of Goods Act 1979 remains important and relevant in many aspects. It continues to provide the general legal framework for sales contracts and includes provisions that apply to both consumer and commercial sales. The Sale of Goods Act 1979 covers various important aspects, such as the definition of a contract of sale, implied terms, passing of property and risk, the seller's duties, and the buyer's remedies. While some provisions have been modified or supplemented by subsequent legislation, the Sale of Goods Act 1979 still forms the foundation of the law governing the sale of goods in many jurisdictions.

Regime of Implied Terms: The Sale of Goods Act 1979 (and its subsequent amendments) sets out a regime of implied terms that apply to contracts of sale unless expressly excluded or modified. These implied terms provide certain minimum standards and protections for both buyers and sellers in a sale of goods transaction.

Remedies Available in Consumer Sales: In consumer sales, where the buyer is an individual purchasing goods for personal use, the Consumer Rights Act 2015 provides specific remedies for breaches of the implied terms. Some of the main remedies available to consumers in the event of faulty or non-conforming goods include:

- Right to repair or replacement: The consumer has the right to request that the seller repairs or replaces the faulty goods.

- Right to price reduction: If repair or replacement is not possible or fails to resolve the issue, the consumer is entitled to a price reduction.

- Right to reject: In cases of substantial non-conformity, the consumer has the right to reject the goods and obtain a refund.

Payment Mechanisms: Payment mechanisms refer to the various methods and systems used for transferring funds and making payments in commercial transactions. Common payment mechanisms include cash, checks, electronic funds transfer (EFT), credit and debit cards, bank transfers, and mobile payment platforms. Each payment mechanism has its own characteristics, benefits, and risks, and its use depends on factors such as convenience, security, and the parties' preferences.

The Nature of the Banking Business: The banking business involves the acceptance of deposits from customers and the use of those deposits to provide loans, credit, and other financial services. Banks act as intermediaries between individuals, businesses, and the financial system. They play a crucial role in facilitating economic activities by providing services such as savings accounts, checking accounts, loans, investments, foreign exchange, and financial advice. Banks are regulated entities, subject to various laws and regulations aimed at ensuring the stability and integrity of the financial system.

Distinguishing Features of a Bank at Law: At law, banks are typically distinguished by certain features:

- Acceptance of deposits: Banks have the legal authority to accept deposits from customers, which are repayable on demand or according to agreed terms. This distinguishes them from other financial institutions that may not have the same deposit-taking capabilities.

- Lending and credit: Banks have the authority to lend money and provide credit facilities to individuals and businesses. This includes issuing loans, mortgages, lines of credit, and other financial products.

- Issuing currency: Banks are often authorised to issue currency and maintain reserves to facilitate transactions and manage monetary policy. This is typically under the supervision and control of a central bank.

- Regulatory oversight: Banks are subject to extensive regulation and supervision by banking authorities to ensure their stability, solvency, and compliance with legal and regulatory requirements.

Bills of Exchange: A bill of exchange is a negotiable instrument that serves as a written order from one party (the drawer) to another party (the drawee) to pay a specific amount of money to a third party (the payee) at a determined future date or on-demand. Bills of exchange are commonly used in commercial transactions to facilitate the transfer of funds and provide a form of credit.

Functions of the Bill of Exchange: The primary functions of a bill of exchange include:

- Payment instrument: A bill of exchange serves as a means of payment, allowing parties to transfer funds without the need for physical cash.

- Credit instrument: It provides a form of credit, allowing the payee to receive payment at a later date, providing flexibility in payment terms.

- Negotiable instrument: A bill of exchange is negotiable, meaning it can be transferred to a third party through endorsement, enabling the payee to use it as a form of payment to others.

- Evidence of debt: It acts as written evidence of the underlying debt or obligation, providing legal proof of the parties' agreement.

Legal Definition of the Bill of Exchange: The legal definition of a bill of exchange varies slightly across jurisdictions, but generally, it refers to a written, unconditional order signed by the drawer, directing the drawee to pay a specific sum of money to the payee on a specified date or on-demand. The bill of exchange must meet certain requirements, including being in writing, containing an unconditional promise to pay, and complying with applicable legal formalities.

Negotiation of Bills of Exchange: Bills of exchange are negotiable instruments, which means they can be transferred from one party to another through a process called negotiation. This is typically done by endorsing the bill, which involves signing on the back of the instrument and delivering it to the new holder. The new holder becomes the payee and gains the right to receive payment from the drawee. The negotiation of a bill of exchange can occur multiple times, allowing for the transfer of the right to payment to different parties along the chain of endorsement.

Credit and Security: Credit refers to the provision of funds or resources by one party (creditor) to another party (debtor) with the expectation that the debtor will repay the funds or fulfil his obligations at a later date. Security, in the context of credit, refers to the collateral or assets provided by the debtor to the creditor as a form of assurance or guarantee for the repayment of the credit. Security helps mitigate the risk for the creditor and provides a means for recourse in case of default.

Concepts of Credit and Security: Credit involves the extension of financial resources or services to another party based on trust and the expectation of repayment. It can take various forms, such as loans, credit cards, lines of credit, or trade credit. Security, on the other hand, refers to the assets or property pledged by the debtor to secure the debt. It provides the creditor with a legal interest or right in the collateral, which can be enforced if the debtor fails to repay the credit.

Mechanisms for Financing and Securing Sales: In the context of sales transactions, various mechanisms can be used for financing and securing the sales. Some common mechanisms include:

- Trade credit: This involves the extension of credit by the seller to the buyer, allowing the buyer to pay for the goods or services at a later date.

- Instalment sales: Under instalment sales, the buyer pays for the goods or services in multiple instalments over a specified period, while the seller retains ownership until the final payment is made.

- Factoring: Factoring involves the sale of accounts receivable or invoices to a third-party (factor) at a discounted rate, providing immediate cash flow to the seller.

- Security interests: A security interest, such as a chattel mortgage or a pledge, can be granted by the buyer to the seller as collateral for the purchase price. If the buyer defaults, the seller has a right to seize or sell the collateral to satisfy the debt.

Real Security: Real security refers to security interests that are created over tangible or real property. Some common forms of real security include:

- Charge: A charge is a security interest created over an asset, giving the creditor the right to payment from the proceeds of the sale of that asset.

- Lien: A lien is a right to retain possession of property belonging to another until a debt or obligation is satisfied.

- Mortgage: A mortgage is a type of security interest that is created over real estate, providing the lender with the right to seize and sell the property if the borrower fails to repay the loan.

- Pledge: A pledge involves the transfer of possession of an asset to the creditor as security for a debt, with the understanding that the asset will be returned once the debt is repaid.

Personal Security: Personal security refers to security interests that involve personal obligations or guarantees. Two common forms of personal security are:

- Surety: A surety is a person or party who guarantees the repayment of a debt or the performance of an obligation if the primary debtor fails to fulfil his obligations. The surety becomes liable for the debt or obligation in case of default.

- Guarantee: A guarantee is a promise or assurance by one party to be responsible for another party's debt or obligations if that party fails to fulfil them. The guarantor agrees to repay the debt or perform the obligation if the debtor defaults.

Requirements of Assignment at Law: To have a valid assignment of a legal right or interest at law, the following requirements must typically be met:

- Intention: The assignor must have the intention to transfer the rights or interests to the assignee. This intention to assign must be clear and unambiguous.

- Valid consideration: A valid assignment usually requires consideration, which refers to something of value given by the assignee to the assignor in exchange for the rights or interests being assigned. Consideration can be in the form of money, goods, services, or any other valuable consideration.

- Validity of assignment: The assignment must not be prohibited by law or public policy. Some rights, such as personal rights or certain contractual rights, may not be assignable.

- Notice: Notice of the assignment is generally not required for the assignment to be valid at law. However, providing notice to the obligor or the party against whom the rights are being assigned can prevent any subsequent competing assignments and protect the assignee's interests.

Requirements of Assignment in Equity: Equity imposes additional requirements for a valid assignment beyond those recognised at law. These requirements aim to ensure fairness and protect the interests of the parties involved. While equity generally follows the same principles as the requirements at law, it may place additional emphasis on the following factors:

- Good faith: The assignment must be made in good faith, without any fraudulent or dishonest intentions. The assignor must not attempt to deceive or mislead the assignee or any other party involved.

- Notice: In equity, notice of the assignment is often considered crucial. Giving notice to the obligor or the party against whom the rights are being assigned is important to establish the priority of the assignment and protect the rights of the assignee.

- No prejudice to third parties: The assignment should not prejudice the rights of third parties who may have a legitimate interest in the assigned rights. If the assignment unfairly affects the rights of innocent third parties, it may not be valid in equity.

Consumer Credit: Consumer credit refers to the extension of credit or financing to individuals for personal, family, or household purposes. It covers various forms of credit, including loans, credit cards, store credit, hire purchase agreements, and instalment plans. Consumer credit is regulated by specific laws and regulations to protect consumers from unfair practices, ensure transparency, and promote responsible lending. Consumer credit laws often impose requirements on lenders, such as providing clear and accurate information about the terms, costs, and risks associated with the credit, conducting affordability assessments, and allowing consumers certain rights to cancel or withdraw from credit agreements. The goal is to safeguard consumers' interests, prevent excessive debt burdens, and promote fair and transparent credit practices.

Agency: Agency refers to a legal relationship between two parties, known as the principal and the agent. The principal grants authority to the agent to act on his behalf in various business or legal matters. The agent is authorised to make decisions, enter into contracts, and perform actions on behalf of the principal, subject to the scope of the agent's authority.

Define Agent: An agent is a person or entity authorised to act on behalf of another party, known as the principal. The agent represents the principal in dealings with third parties and performs actions or makes decisions on behalf of the principal within the scope of the agent's authority. The agent has a fiduciary duty to act in the best interests of the principal and must exercise due care, loyalty, and good faith in carrying out his responsibilities.

How an Agency is Created: An agency relationship can be created through various means, including:

- Express agreement: The principal and the agent may enter into a formal written or oral agreement outlining the terms and conditions of the agency relationship. The agreement specifies the scope of the agent's authority, responsibilities, and the nature of the tasks the agent is authorised to perform on behalf of the principal.

- Implied agreement: An agency relationship may be created based on the conduct and actions of the parties, even in the absence of a formal written agreement. If the principal consistently allows the agent to act on his behalf and the agent consistently performs tasks on behalf of the principal, it can imply the existence of an agency relationship.

- Apparent authority: The principal may create an agency relationship by allowing the agent to represent themselves as having the authority to act on behalf of the principal. If the principal's actions or words lead third parties to reasonably believe that the agent has the authority to act on behalf of the principal, the principal may be bound by the actions of the agent.

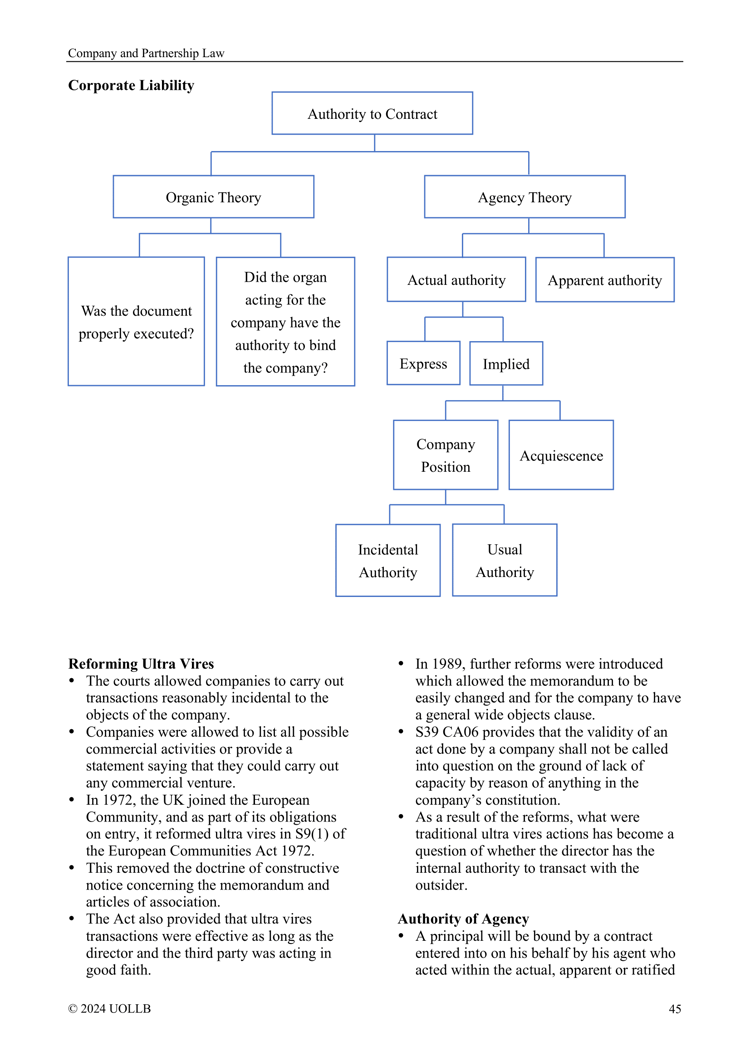

The Scope of the Agent's Authority: The scope of an agent's authority refers to the extent of the agent's power to act on behalf of the principal. The agent's authority can be either actual or apparent.

- Actual Authority: Actual authority is the authority explicitly granted to the agent by the principal. It can be express (specifically stated) or implied (necessarily inferred from the circumstances). The agent's actions within the scope of his actual authority legally bind the principal.

- Apparent Authority: Also called ostensible authority, apparent authority is the authority that a reasonable third party believes the agent possesses based on the principal's conduct or representations. If the principal creates the appearance that the agent has the authority to act on his behalf, the principal may be bound by the agent's actions within the scope of that apparent authority, even if it exceeds the agent's actual authority.

Rights and Obligations Owed by the Principal to the Third Party: The principal is responsible for the actions and representations made by the agent within the scope of his authority. The principal's rights and obligations to the third party include:

- Liability for agent's actions: The principal is liable for any actions or contracts entered into by the agent within the scope of his authority. This means that the principal is legally responsible for fulfilling the obligations and honouring the agreements made by the agent.

- Duty to provide compensation: The principal is generally obligated to compensate the agent for his services as outlined in the agency agreement or as required by law.

- Duty of good faith: The principal has a duty to act in good faith and provide the agent with the necessary resources, information, and support to carry out his authorised tasks effectively.

Rights and Obligations Owed by the Agent to the Third Party: The agent has certain rights and obligations towards the third party with whom the agent interact on behalf of the principal. These include:

- Duty of care and loyalty: The agent owes a duty of care to the third party, meaning the agent must exercise reasonable skill, diligence, and competence in carrying out his tasks on behalf of the principal. The agent must act in the best interests of the principal and avoid conflicts of interest that may compromise his loyalty to the principal.

- Duty of disclosure: The agent may have a duty to disclose his agency relationship and the identity of the principal to the third party. This ensures transparency and allows the third party to make informed decisions when dealing with the agent.

- Liability for breach: If the agent breaches his duties or acts outside the scope of his authority, he may be personally liable to the third party for any resulting harm or losses.

- Right to indemnification: The agent may have the right to be indemnified by the principal for any liabilities incurred while acting within the scope of the agent's authority.

Rights and Obligations Owed by the Third Party to the Principal: The third party with whom the agent interacts may have certain rights and obligations towards the principal, including:

- Duty to perform: If the third party enters into a contract or agreement with the agent within the scope of the agent's authority, the third party has a duty to fulfil his obligations and perform as agreed.

- Right to enforce contracts: The principal has the right to enforce any contracts or agreements entered into by the agent within the scope of his authority. The third party is bound by these contracts and must honour his obligations to the principal.

- Reliance on agent's representations: The third party may rely on the agent's representations and actions within the scope of the agent's authority. If the agent exceeds his authority, the third party may have legal recourse against the agent or seek remedies from the principal.

Commercial Law plays a crucial role in ensuring fair and efficient business practices, facilitating economic growth, and providing a framework for resolving disputes that arise in the business context. It encompasses a wide range of legal principles and rules that regulate various aspects of business transactions, including contracts, sales, financing, intellectual property, competition, and more.

You can learn more about each topic and relevant case law with our exam-focused Commercial Law notes.